benedek/iStock via Getty Images

Camping World Holdings (NYSE:CWH) retails and rents recreational vehicles, as well as products and services related to RVs, including RV covers, Wi-Fi systems, tents, fishing gear, insurance, and financing. The company has retail centers under the Camping World and other names, and services such as insurance and financing under Good Sam. As of Q3, Camping World communicated plans to have 220 locations across the United States by the end of 2024. The amount is constantly growing, as Camping World’s strategy involves a high amount of organic investment as well as acquisitions bolstering growth.

Since the company had an IPO in late 2016, the stock has had a decent return. The stock has compounded at approximately a CAGR of 3.5%, on top of which Camping World pays out a dividend. After a quite recent dividend cut, the company’s current dividend yield stands at 1.99%.

Stock Chart From IPO (Seeking Alpha)

Investing in Growth

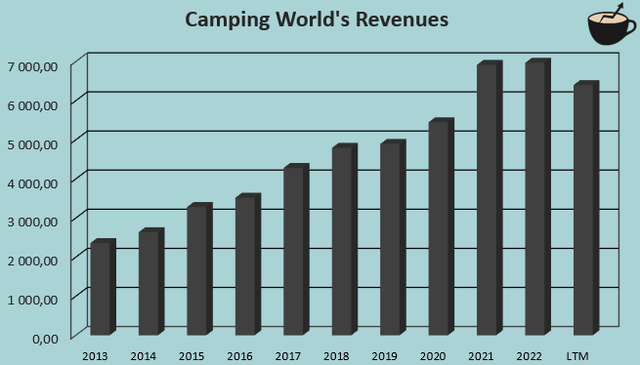

From 2013 to current trailing figures, Camping World has had a revenue CAGR of 10.8%. The revenues were largely boosted during the Covid pandemic, as the industry had an extraordinarily high demand. Since then, the market has normalized, and been further pressured by a weaker macroeconomic sentiment and consumer spending.

Author’s Calculation Using Seeking Alpha Data

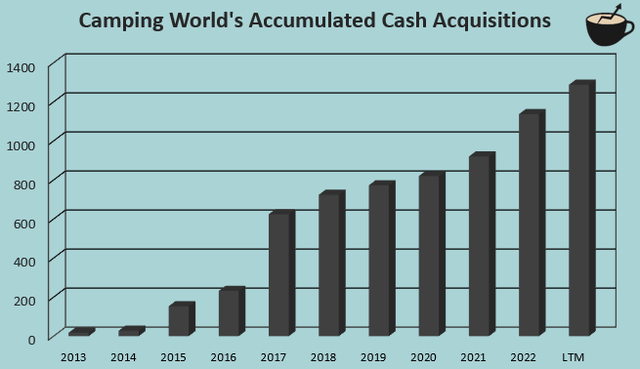

The achieved growth is a result of Camping World’s extensive investments – the company has spent a good amount of cash flows both on acquisitions and capital expenditures. From 2013, Camping World’s cash acquisitions add up to almost $1.3 billion. Camping World plans to increase its total locations to 320 in the next five years, with 15 to be added in Q1 of 2024. In past months, the company has already announced three new locations in Texas and Oklahoma in January, two locations in Louisiana also in January, and the acquisition of Youngblood RV in November. In addition, Camping World has spent $155 million in capital expenditures in 2022 as the company invests in new greenfield locations with planned sale & leasebacks.

Author’s Calculation Using Seeking Alpha Data

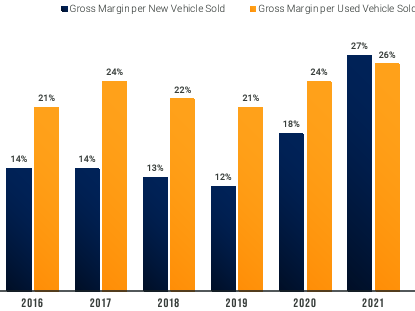

Camping World identifies added service revenues, used vehicle sales, and Good Sam’s RV valuator as growth verticals in addition to growth in locations. The company has around 2800 service bays as of Q3 and plans to expand the number within the coming years. Camping World is underrepresented in the used vehicle market with a 5% market share in 2021, compared to a three times larger new vehicle market share of 15%. Prior to the pandemic, used RVs have had wider gross margins for the company, making the market highly valuable. Good Sam’s RV valuator is designed as a sales funnel, where RV owners can get a valuation on their RVs and potentially complete a sale with the company.

Camping World September 2022 Investor Presentation

Summing up, Camping World has significant efforts to try to continue the company’s historical growth. Ranging from organic and M&A investments to identified service & used vehicle growth verticals. The growth is quite capital intensive, though.

Setting Eyes on a Financial Recovery

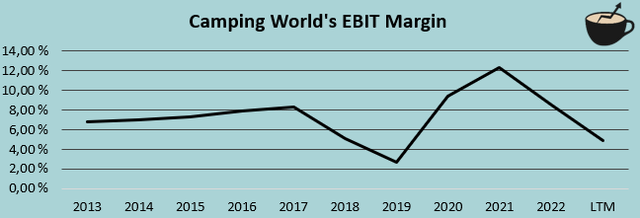

Camping World’s earnings have suffered due to reduced consumer spending. Despite continued investing efforts, the company’s revenues in the first three quarters of 2023 are down 10.0% compared to the previous year’s period. As a result of lower sales, Camping World’s margins have also been pressured, as the EBIT margin has gone down from 8.5% in 2022 to 4.9% with trailing figures.

In the Q3 earnings call, inventory management was mentioned as a critical factor in the turbulent market in past years. Camping World has been able to manage inventories quite efficiently, adding the share of used RVs’ purchases instead of new vehicles as demand has gone down. Also, the diligence in inventory management has relieved some of the earnings pressure, as the adjustment to lower demand has been well adjusted to a lower level of purchasing in 2023. Inventories have gone down from $2124 million at the start of 2023 to $1869 at the end of Q3 despite lower sales.

The company is also streamlining its retail location network – in the third quarter, Camping World closed down two underperforming locations and planned to close down seven more in Q4. As a result of continuing investment and the continuous focus on improving operations, CEO Marcus Lemonis said in the earnings call that earnings could improve by over 30% in 2024. I expect the 2024 earnings expectations to still have a high amount of variability with the greater economy, largely affecting the timeline of recovering demand.

A sustainable EBIT margin level is still quite difficult to estimate. The company’s EBIT margin has ranged from a weak 2.7% in 2019 prior to the pandemic to an extraordinarily high margin of 12.3% in 2021. While gross margins have stayed consistent, and are still above pre-pandemic levels, SG&A has inflated above the revenue growth level. I assume that a part of the SG&A doesn’t yet contribute to revenues, as new retail locations take time to pick up traction. More notably, though, the currently low demand seems to be a dominant factor contributing to the high SG&A/Revenue ratio. The current EBIT margin still stands at 4.9% and does seem to have some upside in the medium term.

Author’s Calculation Using Seeking Alpha Data

I believe that a recovery in demand should slowly begin. Overall inflation has gone down and interest rates have decreased from their peaks, likely translating into a recovering consumer spending. Although the timeline is still unclear, the CEO’s comment of a 30% earnings increase in 2024 points towards a recovery starting in the next year. The Q3 earnings call included some notions of improving demand, shining some hope for Q4 and forward.

Doing Well Against Competition & Industry

Camping World’s main publicly listed competition is Lazydays, on which I have previously made a write-up. Compared to Lazydays, Camping World’s financials have performed very well – for example in Q3, Camping World’s revenues decreased only by -6.8% compared to Lazydays’ -15.9%. Margins have performed mostly similarly between the companies, as Camping World’s EBIT margin is down 3.6 percentage points from 2022 to trailing figures, compared to Lazydays’ 4.7 percentage points. Camping World has better overall margins, though, making the relative loss in earnings in the current turbulence lower for the company.

Compared to RV manufacturers, Camping World is also doing relatively well – THOR Industries lost 61.8% of its FY2022 EBIT in FY2023, LCI Industries’ EBIT is down by 82.3% with trailing figures compared to 2022, and Winnebago Industries’ EBIT is currently down 56.1% from the company’s FY2022 high. The industry’s struggles are impacting Camping World significantly, but the company has taken the hit better than most of the industry. Camping World is doing well against competition, and through extensive investments is poised to gain market share in 2024 as communicated in the Q3 earnings call.

A Volatile Investment With Upside to Baseline Scenario

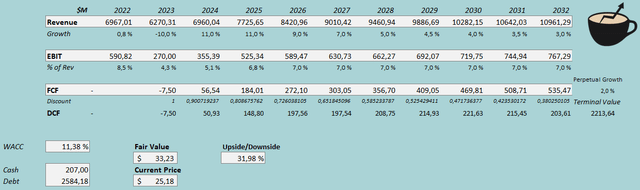

To estimate a fair value for the stock, I constructed a discounted cash flow model in my usual manner. In the DCF model, I factor in further capital expenditures and acquisitions for a few years, creating growth for the company. After a 2023 revenue decline of 10%, I estimate the growth to step up to 11% in 2024 due to a slowly recovering demand with improving customer spending and retail location expansion, but also to see some negative effects from closed locations. Afterwards, I estimate the growth to stay at 11% in 2025, but to slow down into a perpetual growth rate of 2% in steps. The estimated revenues represent a CAGR of 4.6% from 2022 to 2032.

As told, I believe that the EBIT margin has room to expand with a demand recovery and cost measures. I estimate 2023 to have a low EBIT margin of 4.3%, but to scale into a sustained margin of 7.0% within the next three years. The sustainable margin estimate takes into account a somewhat higher amount of gross profit per location, as well as some minimal operating leverage. I expect Camping World’s cash flow conversion to be poor eventually due to high investments, but to improve into a good conversion with slowing acquisitions.

With the mentioned estimates along with a cost of capital of 11.38%, the DCF model estimates Camping World’s fair value at $33.23, around 32% above the stock price at the time of writing – my estimates imply that the stock has a good amount of upside, creating a high risk-to-reward. Still, it has to be noted that the investment case for Camping World is highly volatile – the future investment rate and profitability can still largely vary, and the company’s leveraged balance sheet further exposes investors to the variance.

DCF Model (Author’s Calculation)

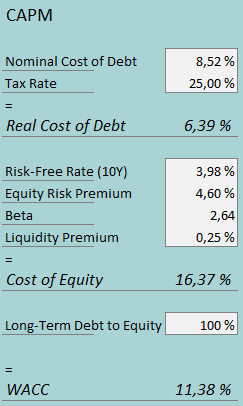

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q3, Camping World had $55.1 million in interest expenses. With the company’s current amount of interest-bearing debt, Camping World’s annualized interest rate comes up to 8.52%. Due to Camping World’s high amount of both long-term debt and short-term borrowings related to retail inventories, I estimate a long-term debt-to-equity ratio of 100%.

For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 3.98%. The equity risk premium of 4.60 % is Professor Aswath Damodaran’s latest estimate for the United States, made on the 5th of January. Yahoo Finance estimates Camping World’s beta at a figure of 2.64; RVs have a somewhat cyclical demand, and Camping World’s high debt leverages the risk. Finally, I add a small liquidity premium of 0.25%, crafting a cost of equity of 16.37% and a WACC of 11.38%.

Risks

The stock doesn’t come without risks. The most notable risk in my opinion is the balance sheet, which has around $2.6 billion in interest-bearing debts. Interest expenses currently cover around 65.5% of Camping World’s EBIT, making the amount of debt worrying in my opinion. The company does have a good amount of inventory, though, which could potentially be sold at discounted prices to cover debts in an alarming situation. Still, such a scenario is likely to lose investors a very high amount of capital.

Also, as represented by the high beta, the company is highly exposed to macroeconomic risks. Further pressure on consumer spending could deteriorate Camping World’s operations, pressuring earnings significantly. With the highly leveraged balance sheet, any changes in demand are leveraged for shareholders.

Takeaway

Camping World is investing in growth even during a currently pressured consumer sentiment. The company has plans to open up a very significant amount of new retail locations and to expand used vehicle sales in which the company has already made good progress. Although earnings are currently pressured, and the timeline for an earnings recovery is still quite cloudy, I believe that the stock could be a worthy investment – the current valuation seems to provide a good amount of upside if my financial assumptions are near right. The investment case could still vary a lot with future financials as well as due to Camping World’s leveraged balance sheet. As the risk-to-reward seems favorable at the moment, I have a buy rating for the stock.