big river

Nabors (NYSE:NBR) stock has been under pressure over the past 18 months due to its weak balance sheet and softening onshore US demand. While there is mounting risk of an oil market downturn, which Nabors could find difficult to navigate, there are international tailwinds that could prove economically insensitive. Nabors valuation is currently modest, providing significant upside potential if market conditions remain steady and the company can reduce its debt burden.

Market

The rig count in North America remains under pressure, although appears to have stabilized over the past 3 months. Nabors has suggested that leading-edge pricing has also stabilized. LNG is expected to support drilling for gas in the US, particularly in the Haynesville. Operators remain disciplined though, and this, along with consolidation, could limit activity and prices.

Activity in North America will likely depend on the willingness of OPEC to support prices through supply cuts. While there is a genuine risk that OPEC will lose its patience for supply cuts, the more I think about it, the more I believe that OPEC could be forced to accept market share losses. Shale producers are far better positioned to manage lower oil prices than they were in 2014. Any downturn will likely need to be extended and severe to have an impact on non-OPEC supply. The previous attempt to wash shale producers out of the market was also largely a failure. In addition, US oil production is probably approaching a peak, limiting the need to push shale producers out of the market. OPEC may also feel that current prices are a result of temporary economic weakness. If this is the case, it may be worthwhile limiting supply until the demand environment improves.

Nabors believes the outlook for international markets is positive. 11 deployments are expected in 2024, with the prospect for additional rigs in Kuwait, Algeria, Oman, Argentina, and Columbia. Improved utilization internationally is expected to lead to higher pricing. Even in the event of a downturn, energy security concerns on the back of elevated geopolitical tensions could cause some producers to continue pursuing supply growth.

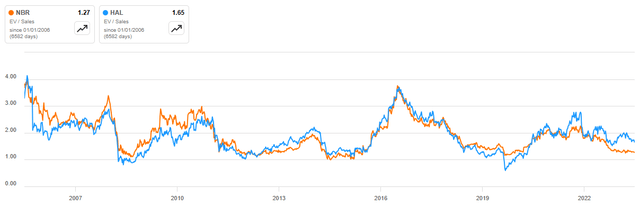

Figure 1: Nabors’ Q3 Rig Utilization and Availability (source: Nabors)

Nabors

While Nabors is having success embedding high-margin technology into its rigs, and generating revenue from third-party rigs, it remains fundamentally dependent on drilling activity. This is problematic in the onshore US, as productivity gains are weighing on demand for rigs. Innovations like pad operations, cube developments, longer laterals and automation mean that more can be done with less. This is a negative for drillers as day rates do not reflect productivity gains.

One area that Nabors could stand to benefit going forward is in the drilling of longer laterals. Nabors’ M1000 rig has a million-pound hook load that is suited to longer lateral lengths. Nabors has also introduced a new top drive that can handle longer laterals.

Activity continues to pick up internationally, with Nabors recently deploying a new build rig in Saudi Arabia and a rig in the UAE. Nabors also has 11 rigs that have been awarded and will be deployed before the end of 2024. Another 7 rigs have been awarded that are expected to be deployed in 2025. Nabors also has 4 rigs in Venezuela that could be reactivated at some point.

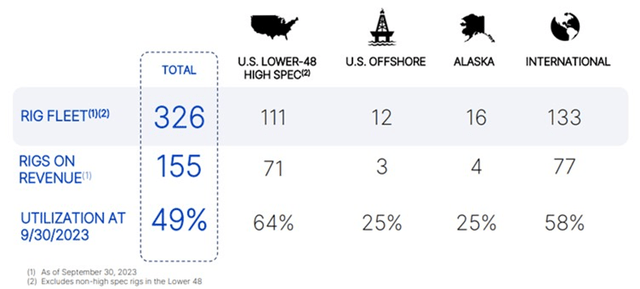

Nabors Drilling Solutions continue to expand, resulting in high-margin revenue. Penetration of NDS services has been steady at nearly 7 per Nabors rig. Nabors is seeing increased adoption of its Smart Slides directional steering system and smartNAV directional guidance software. Nabors has also seen increased interest in utilizing its software solutions on third-party rigs.

While NDS is a positive for Nabors, it is also representative of the issue facing onshore drillers in the US. Drilling productivity has improved enormously in recent years, but this has ultimately reduced demand for rigs without creating higher prices. NDS allows Nabors to capture some of the value it is creating, but overall productivity probably continues to be a negative.

Figure 2: Smart Suite Growth Trajectory (source: Nabors)

Nabors also has a number of energy transition initiatives which are accretive to margins:

Power tap module – connects rigs to the electricity grid. At the end of September, Nabors had 23 modules running at the end of Q3, with over 20% of those on third-party rigs. The market appears to be shifting in this direction, providing Nabors with a tailwind. For example, Exxon Mobil (XOM) has 17 rigs operating in the Permian, all of which are electrified. NanO2 diesel fuel additive – improves engine performance and reduces emissions. Nabors has treated more than 22 million gallons of diesel on both drilling rigs and pressure pumping units.

A YEAR

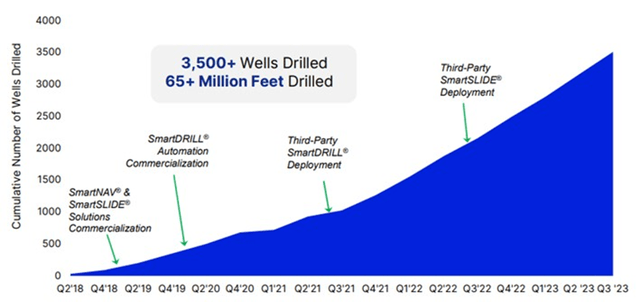

Nabors expects to deploy 50 rigs in Saudi Arabia over a 10-year period, with 15 rigs awarded to date. Saudi Arabia wants to eliminate the use of oil in power production by 2030 by leveraging its large gas reserves, freeing up to 1 million bpd of oil for export. This potentially makes SANAD relatively insensitive to economic conditions.

The fourth rig was deployed in Q3. The fifth rig was also expected to be deployed in the third quarter, but delivery delays has now pushed this into early 2024. This delay, along with field performance challenges, negatively impacted EBITDA by roughly 5 million USD in Q3. The second tranche of five rigs is currently under construction, with the first of these expected to spud in Q1 2024 and the last in early 2025. The third tranche of five new builds was recently awarded, and Nabors expects to begin deployment in the middle of 2025.

Figure 3: SANAD Estimated Average Rig Count Potential (source: Nabors)

Financial Analysis

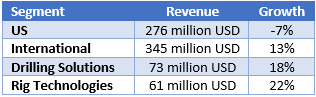

Nabors’ third quarter revenue was 734 million USD. Drilling activity and pricing weighed on Nabors’ onshore US business, and US offshore revenue was impacted by planned maintenance. International revenue expanded on the back of activity in Saudi Arabia, Argentina and Mexico. This was somewhat offset by the end of contracts in Kuwait and Columbia. Drilling solutions revenue reflects a mix of lower drilling activity in the US, offset by growth amongst third parties and international expansion.

Table 1: Nabors Revenue by Segment (source: Created by author using data from Nabors)

Fourth quarter revenue is likely to be in the vicinity of 744 million USD, with slightly improved margins.

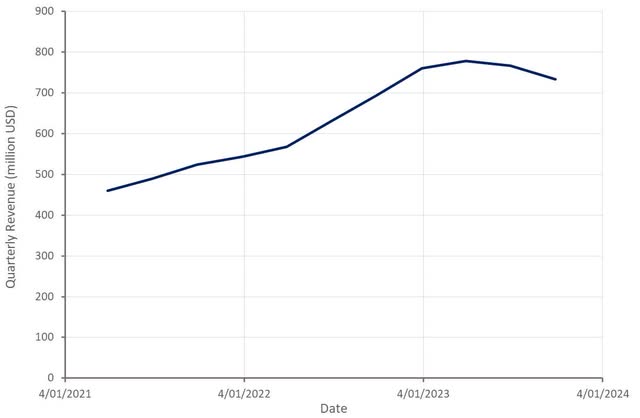

Figure 4: Nabors Revenue (source: Created by author using data from Nabors)

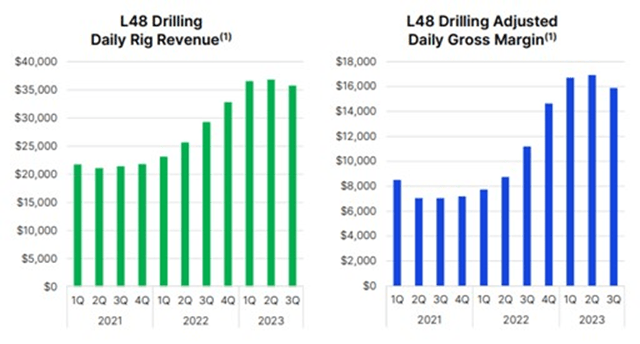

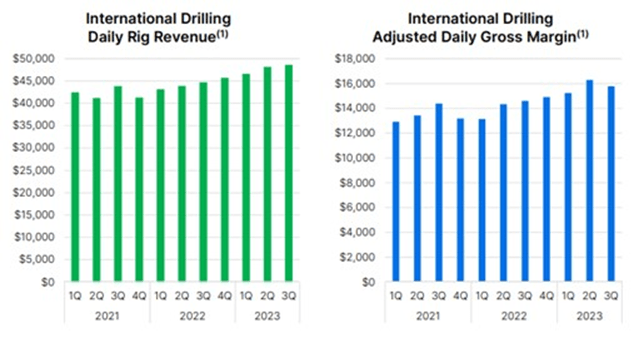

Lower activity in the lower 48 has created some pressure on pricing and margins. Nabors continues to see pricing and margins move higher in international markets, though.

Figure 5: Lower 48 Day Rates and Margins (source: Nabors) Figure 6: International Day Rates and Margins (source: Nabors)

Nabors adjusted EBITDA was 210 million USD in the third quarter, reflecting a decline in lower 48 drilling activity as well as issues in Saudi Arabia. Adjusted EBITDA for the Alaska and US offshore businesses was 16.5 million USD. This was impacted by planned downtime for Nabors’ M400 rig in the Gulf of Mexico. International EBITDA was 96.2 million USD due to a lower-than-expected rig count and daily gross margins. Much of this was due to the issues in Saudi Arabia. Drilling solutions adjusted EBITDA was 30.4 million USD, which was negatively impacted by lower drilling in the lower 48.

Given the fact that the rig count in the US has stabilized, and that international activity continues to pick up, Nabors’ profitability should improve going forward. Particularly if some of the temporary issues that plagued the company in the third quarter can be reduced.

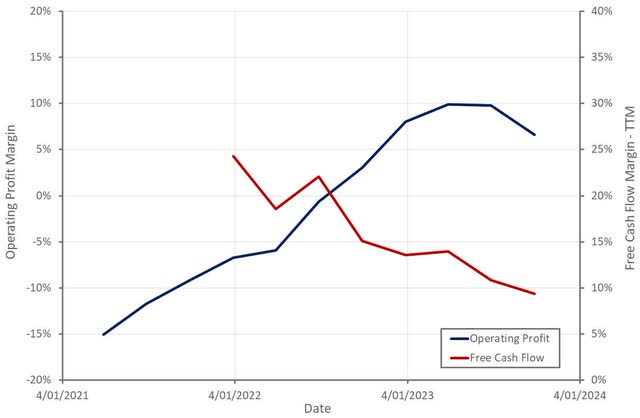

Improving profits must be weighed against the fact that Nabors is investing in its business to support growth, dragging on cash flows. Both capital investments and working capital have reduced cash flows in recent quarters. Recent CapEx includes an Algerian deployment, purchase of a base in Argentina and new builds for SANAD. Higher CapEx is due to the accelerated timing of investments in Saudi Arabia and the US. CapEx is expected to decline significantly in the fourth quarter though and third quarter working capital increases should unwind. Fourth quarter free cash flow is therefore expected to be around 150 million USD.

Figure 7: Nabors Profitability (source: Created by author using data from Nabors)

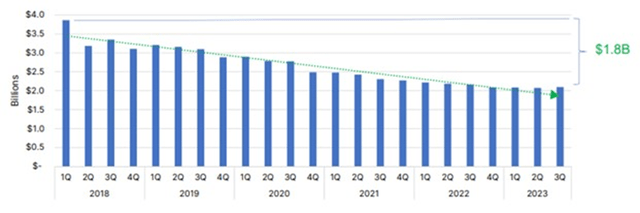

While Nabors has managed to reduce its debt load in recent years, the company’s situation is still somewhat precarious. Interest expense continues to consumer much of the company’s profits and cash flows. Nabors really needs solid market conditions to persist for some time so that debt can be reduced to more sustainable levels.

Figure 8: Nabors Net Debt (source: Nabors)

Conclusion

I am skeptical of economic conditions and fairly neutral on oil markets but believe there are pockets of opportunity in the sector. Given economic uncertainty and Nabors’ debt, I probably wouldn’t invest in the stock, but the market appears to be overly bearish on Nabors.

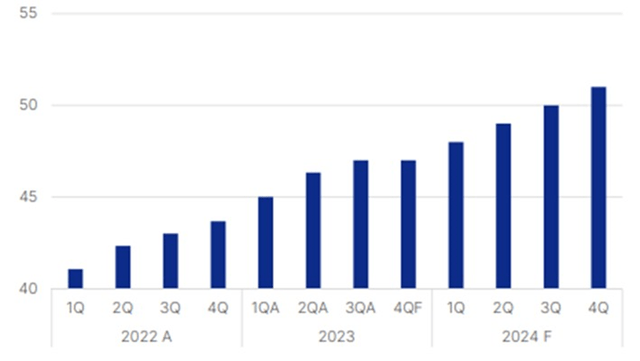

While I wouldn’t draw to many conclusions from a comparison of Nabors and Halliburton, as they are quite different businesses. They are exposed to similar demand drivers and competitive dynamics, though, and hence their valuations exhibit similar movements. Nabors’ valuation has moved lower in recent months, reflecting growing concerns of a market downturn.

If the US onshore market stabilizes and international activity continues to pick up, Nabors’ stock could do well from current levels. This situation is dependent on both economic activity remaining resilient and OPEC continuing to support oil prices through supply cuts.

Figure 9: Nabors Relative Valuation (source: Seeking Alpha)