Torsten Asmus

The Time for Cash is Over

“While it’s easy to get attached to high-yielding cash, especially when it yields more than some bonds, it’s also important to understand why it may be time to move into bonds. The bottom line is that holding cash while waiting until there’s more certainty in the economic outlook, the Federal Reserve’s (Fed) path, or the geopolitical environment could cost total return relative to bonds based on the past six interest-rate hiking cycles.” –Wellington Management

Money flows into money market funds have been significant as investors seek to capitalize on 5%+ rates on their cash. As we move through the remainder of this cycle it is likely that the Fed will keep rates elevated for a period of time to dampen any remaining inflation in the system and get the rate back to the 2% target. Unfortunately for cash investors as the Fed does embark on reducing rates, they will see the rates paid on their cash fall. This can be combatted by investors seeking to increase duration even modestly to lock in higher rates for longer.

If inflation is falling, the Fed has to change its nominal rate, so I could see the Fed cutting by 100Bps this year to maintain a neutral rate, but we are unlikely to see the six cuts the market is currently pricing in. The one exception for this, is if we see a material change in the economic data that would warrant further cuts in rates.

Wellington Management looked at past rate cycles and found the following:

Our analysis looks at two timeframes. The first one starts at the last interest-rate hike in each Fed tightening cycle since 1983 (Figure 1). The second one starts at the first hike of each Fed-tightening cycle since 1983 (Figure 2).

Why has the experience in bonds been superior to cash? There are three key reasons:

1. Whether or not the investment horizon begins with the first hike or the last hike of each Fed-tightening cycle, it incorporates the next Fed easing cycle when the yield curve steepens with short-term rates falling.

2. The market anticipated rate cuts in each tightening cycle three to 13 months before the next rate cut, adding positive return in this period. Thus, an investor wanting to time the entry into bonds needs to be early. While bonds may not fare as well as cash if you’re early, we show that bond returns are comparable to cash in the short term, and the ensuing easing cycle more than compensates.

3. Cash also tends to suffer during easing cycles as its yield drops along with Fed interest-rate cuts.

We analyzed the three-year total returns of cash, Treasuries, bonds (as represented by the Bloomberg Aggregate Bond Index), and corporate bonds (as represented by the Bloomberg US Corporate Bond Index) starting from the last hike of each of the past six full US Fed interest-rate tightening cycles since 1980. We also ran the same analysis giving cash an “advantage.” To do this, we began our total return analysis from the first hike instead of the last hike.

They continue showing the results of their study of rate cycles. While all bond strategies outperformed cash, what is most interesting to me is how corporate bonds outperformed Treasury bonds due to spread compression.

Figure 1 illustrates that returns for all the bond strategies we observed were around double the returns of cash. Figure 2 shows that returns for the bond strategies were seven to 10 percentage points better than cash. In both analyses, corporate bonds outperformed Treasuries and the Bloomberg Aggregate Bond Index due to their higher yield and periods of spread compression, which added net positive return.

Figure 1

Wellington Management

Figure 2

Wellington Management

Given this analysis, it seems investors would be wise to consider bonds over cash in the current cycle. Looking further, I believe investors should also choose bonds over stocks for multiple reasons. First, is the current starting valuation of stocks. Second, is the high yields on bonds from corporate bonds to high yield, floating rate, to Treasury bonds are sporting yields of anywhere from 4% to as high as double digits. This starting point for bonds is far more attractive than where stocks sit currently.

The Case for Bonds in 2024

The economy has defied the bears entirely, clocking in double digit returns in 2023, and expected to produce positive returns in 2024. With such a backdrop, investors may wonder, why should I bother with fixed income securities?

Investors ask this question of course because of their naivete, and lack of knowledge of investment history. Investors in the 1920’s asked themselves the same question, it is perennial that an investor should ride the waves of greed and fear all through their investment lives.

As Charles Mackay taught us in Extraordinary Popular Delusions and the Madness of Crowds, people think in herds, this herd behavior is one of the driving forces behind the momentum of market movements.

Recency bias takes over and investors believe the stocks that have been going up every year, will continue going up in perpetuity. Any student of market history knows this is not the case. There will be a reversion to the mean, and a return to sanity of the herd.

Bloomberg

The case for bonds is a case to break free from the cycle of greed and fear, and instead follow an evidence-based framework that aims for an investor to be compensated for the risk they are taking, know their rate of return, and their maturity date. To move away from risk when investors are not paid to take it, and towards risk when they are. The idea that stocks should produce a premium return vs. bonds in all periods, is simply not the case.

Investors may produce outsized returns with stock portfolios, but what they do not seem to realize, is that much of this return comes from uncompensated risk. Take the S&P 500 index fund from Vanguard (VFINX). Consider that if we take returns from this century, the return and Sharpe ratio were 6.91% and 0.40 respectively.

Investors only focus on the 6.91% return, which outpaced inflation, and the total bond index which returned 4.08%. But most investors do not focus on the fact that they took more than 2x the risk than they were provided compensation for in the stock market. A Sharpe ratio of 0.40 means investors were not compensated for the risk they took. They also do not focus on the fact that during this period, investors took on a standard deviation of returns, another measure of risk, of 15.03. Investors also do not consider that there is no guarantee of an equity risk premium.

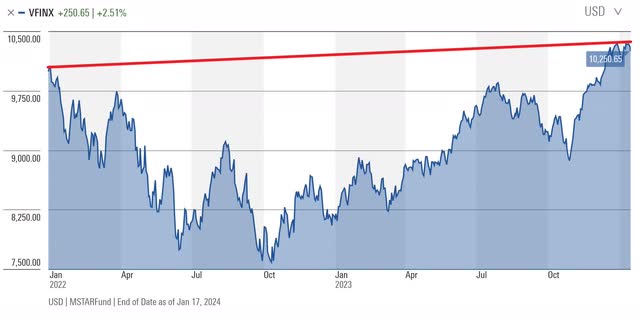

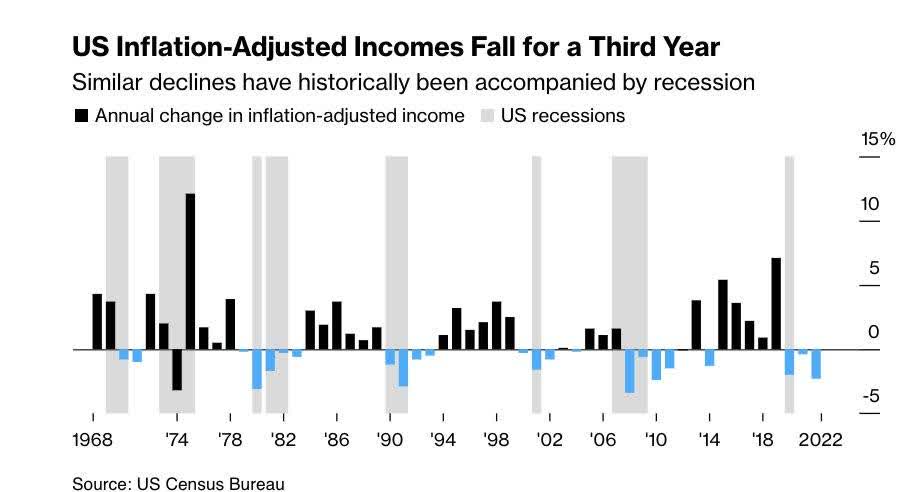

This is also an argument for alternative investments as a third pillar to compliment stocks and bonds. Consider that stocks today, are where they were two years ago. Meaning that when we adjust for inflation, stocks have produced a negative real rate of return during this period.

Morningstar

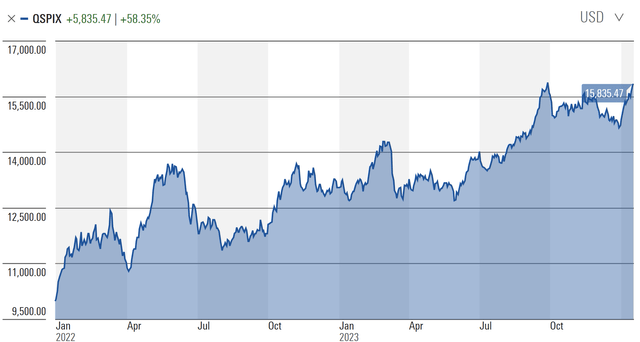

But an investor who added AQR Style Premia (QSPIX) as an example of a total alternative strategy, would have gained more than 58% during the same period in this sleeve of the portfolio.

Morningstar

In today’s current environment with rates toping 5% on government bonds and even higher in corporate credit, the expected returns for investors are excellent compared to the recent past. Just last year investors could have locked in 5% on a 30-year bond.

Tradeweb Y-Charts

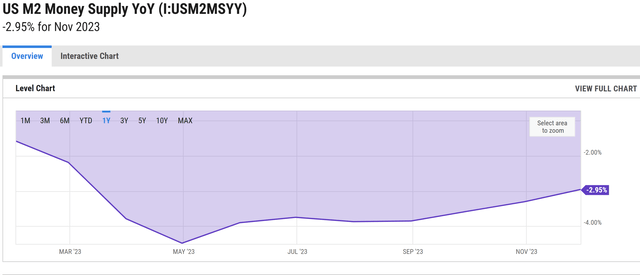

A further economic case can be made for why bonds are the right asset, right now. Indicators such as the number of people with multiple jobs, inflation adjusted wages, credit card balances, delinquencies, and most importantly M2, all show an economy headed for recession and a deflationary storm brewing.

Bloomberg

The best asset to hold in deflation are US Treasury bonds, notes, and bills. For retirement investors who cannot lose money, a quality asset, that is negatively correlated with stocks in left tail events that will prosper during a deflationary storm, seems to me to be an important part of a well-diversified portfolio.

Conclusion

For investors who want to expand their bond portfolio, I think the best strategy in this cycle is to take a barbell approach combining high-quality long-term US Treasury bonds with corporate credit, and high yield bonds at the shorter to intermediate end. I also think investors need not stay in the US, with many opportunities in the corporate bond markets around the world on a hedged and unhedged basis.

My regular readers know that I prefer to own individual securities to be able to tailor your duration and yield to your own needs and portfolio objectives, but there are plenty of bond funds that may fit the bill as well for those investors who lack the skill, or time to analyze individual securities for their portfolio.

In conclusion, investors who are sitting in cash have a real opportunity to extend duration not only to extend to higher long-term yields, but also for opportunities to capture capital gains based on the evidence from past cycles. Additionally, stock investors who have not rebalanced their portfolio also have a chance to diversify their portfolio with fixed income, which I believe will be a better investment through a full investment cycle.