adamkaz/E+ via Getty Images

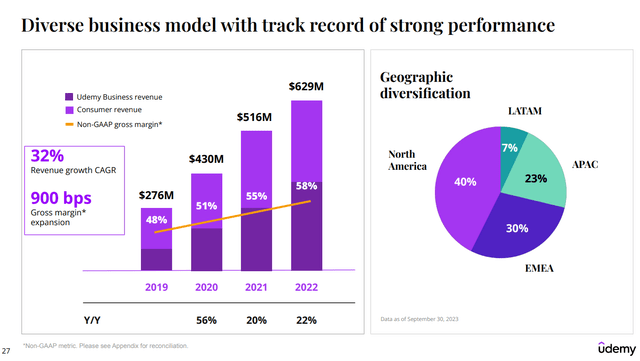

Udemy (UDMY) is taking several actions that make it interesting as a platform. It has latitude to decrease instructor earnings, and have plans to do so quite substantially. Moreover, generative AI is resulting in substantial demand effects on the business offering, but also may do more to commodify instructors and help create more content. In addition to the sales results being substantially ahead of expectations due to the business segment, we think major shifts are coming in the industry structure for Udemy and similar platforms.

Earnings Call

Revenue increased 17% year-over-year to $185 million or nearly $5 million above the high end of our guidance range. The year-over-year growth included a negative impact from foreign exchange, or FX, of 1 percentage point.

Sarah Blanchard, CFO

The FX effects aren’t big, and are coming from a growth of non-NA revenue in the mix.

In general, the demand picture has been of all the growth being driven by the half of the business that focuses on a per-seat model of courses used by businesses to train or upskill talent.

Split (Q3 Pres)

In particular, the need to address generative AI in the workforce is driving a lot of demand, as courses have cropped up that companies are making sure to be on top of as they figure out what to make of generative AI in their respective businesses.

On the consumer side, demand has been slow on account of consumer care over discretionary spending, but they have maintained their current level of revenues.

As a platform for courses, Udemy’s primary value driver is that as the platform grows, their bargaining power with respect to all stakeholders becomes more substantial. The environment becomes more competitive for instructors, and the offering becomes broader, higher quality, and more compelling for the growing pool of users as instructors compete for their attention.

We believe that the accelerated growth in generative AI and the stepwise technological developments in AI that have allowed it to become obviously useful in the economy are resulting in both growth in the platform to the benefit of Udemy’s industry structure and position, but also gives Udemy yet another tool to commodify instructors. While currently they are mainly talking about using generative AI to help instructors address student questions based on the course materials, which is a pretty smart applications, generative AI can reduce the value-add proposition of human instructors in other ways too and is allowing for the most important update from Udemy, which is a change in instructor revenue share.

Under the current payment structure, instructors earn 37% of revenue for individual course purchases on Udemy’s marketplace. Instructors earn 25% for Udemy Business in our Personal Plan subscription offerings, which is allocated pro rata based on consumption of their content…

… Under the new structure, the revenue share for the marketplace will remain unchanged, but we will be gradually reducing the instructor share of subscription revenue. Our first adjustment to 20% will be effective January 1, 2024, followed by 17.5% in 2025 and 15% in 2026.

– Sarah Blanchard

Bottom Line

This is going to have substantial GM effects, where the COGS contains this instructor compensation for the subscription plans. In 2026, share in Udemy Business for instructors will fall to 15% from 25% or by 40%. This will reduce cost of revenues very substantially, probably quite close to 40% in the Business segment, which represents half of the revenues currently and is driven primarily by license subscription revenues. Udemy thinks that it can bring up GMs from the 59% run-rates to a 70% by the end of 2026, which means better throughput on growing revenues. There is a forecast of 300 bps annual improvement in GMs from the reduction in instructor share planned. While EBITDA will remain flat for the time being, these changes seem likely to get margins to 20% in 2027 on EBITDA. This also implies a 50% increase in operating expenses assuming continued 15% annualised revenue growth, which we feel is reasonable over 3 years, and no more will be needed.

Udemy has a 20% dilution overhang from reserved internal options. This somewhat caps the upside. Moreover, the company is burning cash, but we feel confident that they have 2-3 more years based on normalized cash burn from last year, since this year had some very favorable receivable effects due to timing.

In all, Udemy is structurally interesting. It trades at around 11x EV/2027 EBITDA including dilution effects and assuming the current cash balances are driven down to zero, which is not too unreasonable by then. 2027 is quite a while away, though, and discounting matters. But 11x including dilution is not that expensive. Moreover, all of our back of the envelope calculations assumes the consumer segment never grows again, which is a conservative assumption. Honestly, not an ugly pick right now.