olando_o/iStock via Getty Images

As a proponent of an income compounding approach to dividend investing, I am often challenged with comparisons to a more traditional dividend growth strategy that focuses on dividend growth and total return. The concept of total return in the context of DGI (dividend growth investing) means price appreciation from an initial investment along with dividend income that grows year after year. The income compounder approach that I utilize to grow my dividend income stream focuses on reinvesting and compounding shares of dividend-paying investments, rather than focusing on the total “value” of my holdings, which can vary from day to day based on current market conditions. I recently reviewed the latest changes to my Income Compounder portfolio, if you would like to learn more about my approach.

There are currently about 150 Dividend Champions – stocks that have raised their dividend every year for at least 25 years, available for investors to choose from. Many of them are loved by DGI investors who seek that strong total return and dividend growth over many years of investing. One of those Dividend Champions that leads the pack in terms of annual increases is American States Water Company (NYSE:HOUR), which has raised its annual payout for 69 years in a row.

But does that mean that investors should buy shares of AWR now and hold those shares for the next 10, 20, 30 years or longer? Depending on your own investing goals and objectives, I believe that there are better choices to grow your future income stream. I rate AWR a Hold at its current price and based on the most recent 5-year performance of the stock.

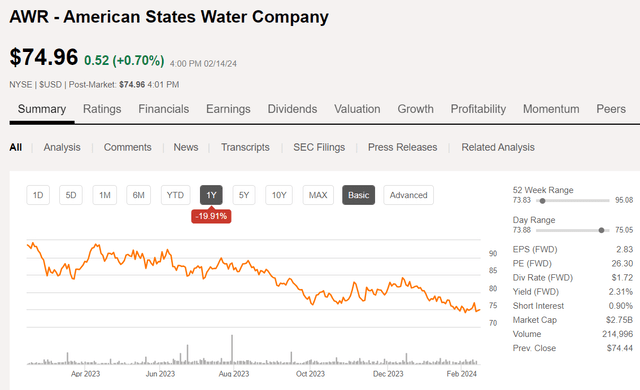

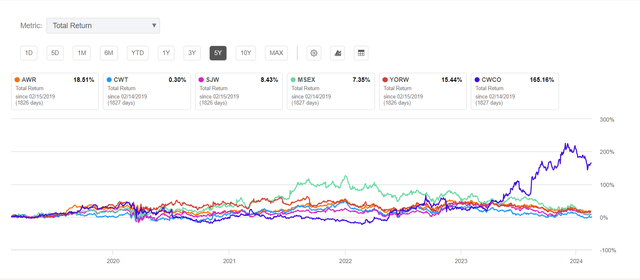

The impacts of the Covid pandemic and extended drought in the western US hurt the stock performance and it has yet to recover, nearly four years later. In fact, over the past 5 years the total return has been about 16% or a little over 3% per year on average, and that is with dividends reinvested. That means that an investment in AWR five years ago would have barely kept up with inflation, let alone provide an income stream that one could depend on.

Seeking Alpha

Why Buy AWR?

Water is perhaps the most valuable resource on Earth. If you have read any of my previous articles you may have noticed that I like to write about water and investments in water. My 40-year career prior to my retirement last year involved about half those years working for various water companies and public agencies including two different water utilities and a state water resource agency in Idaho. Water utilities provide an essential commodity that only grows more valuable each year as clean, fresh water becomes scarcer around the world due to growing populations, climate change, increasing demand, and various other factors. In fact, in a previous article that I wrote about Consolidated Water Company (CWCO), I suggested that water may be more valuable than oil.

American States Water has been paying dividends to shareholders every year since 1931. From the most recent dividend declaration, AWR describes their current payout and dividend philosophy:

On February 6, 2024, the Board of Directors of American States Water Company approved a quarterly dividend of $0.43 per share on the Common Shares of the company. This action marks the 351st consecutive dividend payment by the company. For 69 consecutive years, American States Water Company shareholders have received an increase in their calendar year dividend, which places it in an exclusive group of companies on the New York Stock Exchange that have achieved that result. The company’s current policy is to achieve a compound annual growth rate in the dividend of more than 7% over the long-term. The company’s quarterly dividend rate has grown at a compound annual growth rate of 9.4% over the last five years.

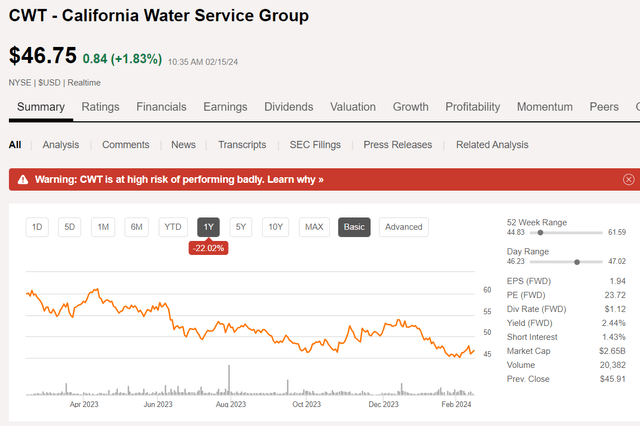

However, that dividend growth has come at the expense of a declining share price over the past few years. In fact, just in the last one year the share price has declined by nearly 20%. Furthermore, the February dividend announcement was inline with the previous quarter, and it was not an increase over 2023. Unless a dividend increase is announced later this year, the streak may end at 69 years.

Seeking Alpha

Valuation and Ratings

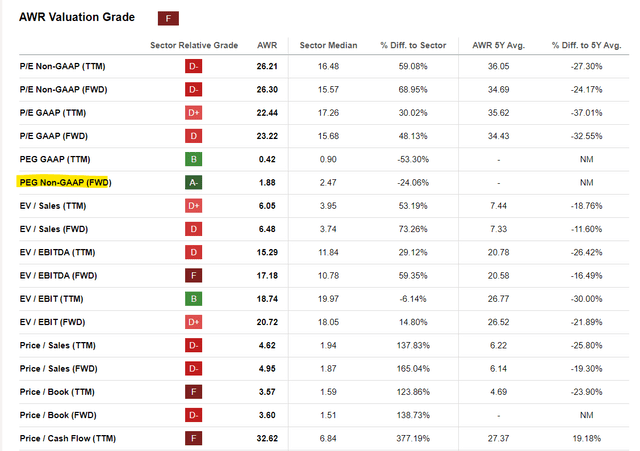

One could then ask if AWR offers good value at the current price. While the stock performance over the past five years has been sub-par perhaps the next five years will improve. Unfortunately, things do not look encouraging from a growth or value standpoint for AWR. In fact, the SA Quant ratings give AWR an F grade for Valuation, although there is one bright spot that is the Forward non-GAAP PEG (price to earnings growth) ratio.

Seeking Alpha

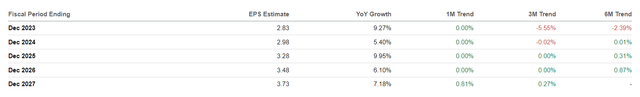

There is some potential for EPS growth and looking at the EPS estimates and revisions it appears that most analysts do anticipate some modest earnings growth over the next few years.

Seeking Alpha

Based on the outcome of the rate request that AWR filed on behalf of its subsidiary Golden State Water in August 2023 for rate increases from 2025 through 2027, the company could see an increase in revenues during that 3-year period. However, the rate case assumes that $611 million in capital expenses will be required to support a core business investment in the infrastructure during that 3-year period. The rate case for Golden State Water is just one of many Class A rate cases that the California PUC is currently considering.

Q3 2023 Results

A favorable ruling from CPUC did result in a substantial YOY increase in earnings reported in Q3. When the company announced Q3 results on November 6, 2023, this is what the press release explained regarding the earnings beat they reported:

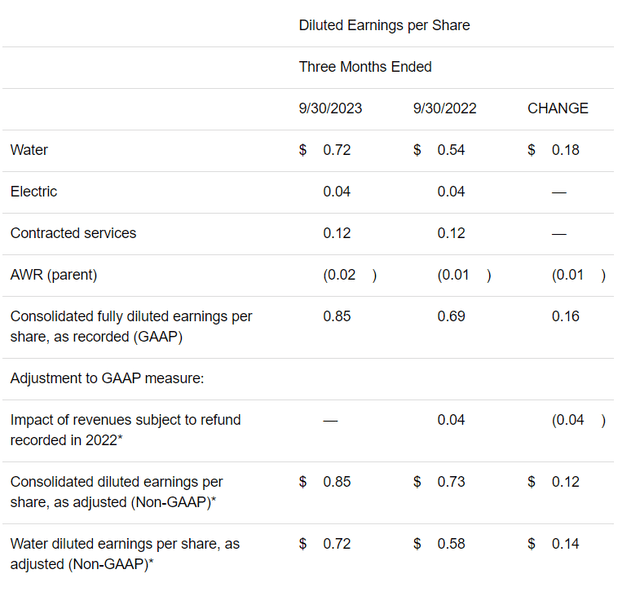

American States Water Company today reported basic and fully diluted earnings per share of $0.85 for the quarter ended September 30, 2023, as compared to basic and fully diluted earnings per share of $0.69 for the quarter ended September 30, 2022, an increase of $0.16 per share, or 23.2%, which includes a favorable variance of $0.04 per share resulting from the impact of accounting estimates recorded in the third quarter of 2022 for revenues subject to refund related to the pending cost of capital proceeding at that time, which were subsequently reversed during the second quarter of 2023 upon receipt of a final decision adopted by the California Public Utilities Commission.

But those improved quarterly results were basically due to a one-off adjustment to water rates and are therefore not likely to result in future earnings improvements. In fact, the earnings results for the nine months ended September 30, 2023, were substantially higher than the same period in 2022 due to the favorable rate case decisions that were retroactively applied to 2022 and 2023.

On June 29, 2023, the CPUC adopted a final decision in GSWC’s general rate case application that determines new water rates for the years 2022-2024 retroactive to January 1, 2022. Because of receiving a final decision in GSWC’s general rate case, second-year rate increases for 2023 have been reflected in the three and nine months ended September 30, 2023. Through the nine months ended September 30, 2023, this included increases in revenues of $36.8 million, or $0.72 per share, compared to the adopted 2021 rates, and increases in supply costs of $8.0 million, or $0.16 per share, which combined is an increase of $0.56 per share for the nine months ended September 30, 2023.

American States Water is more than just a water company. The company also owns an electric utility and provides contracted water and wastewater services to military bases across the US as well. From the company’s Q3 press release, this is how AWR describes the overall business:

American States Water Company is the parent of Golden State Water Company, Bear Valley Electric Service, Inc. and American States Utility Services, Inc., serving over one million people in nine states. Through its water utility subsidiary, Golden State Water Company, the company provides water service to approximately 264,100 customer connections located within more than 80 communities in Northern, Coastal and Southern California. Through its electric utility subsidiary, Bear Valley Electric Service, Inc., the company distributes electricity to approximately 24,800 customer connections in the City of Big Bear Lake and surrounding areas in San Bernardino County, California. Through its contracted services subsidiary, American States Utility Services, Inc., the company provides operations, maintenance and construction management services for water distribution, wastewater collection, and treatment facilities located on 12 military bases throughout the country under 50-year privatization contracts with the U.S. government.

The GSWC water business is responsible for the vast majority of AWR revenues as well as the costs incurred. From the Q3 earnings report the breakdown of EPS contributions by business segment shows the earnings contribution from each segment in greater detail:

AWR

Although rate adjustments are helpful in improving the revenues realized from delivering water to residents of California, the rising costs of water utility bills are not due to increasing profits. According to Bluefield Research, the average household water and sewer bill for 50 major US cities has increased by an average of 4% per year over the past ten years.

“While the reasons for rate increases vary city by city, many have been in response to rising costs (i.e., inflation, labor) for ongoing system operations and maintenance, along with large capital investments to address aging infrastructure,” noted Charlie Suse, Senior Analyst at Bluefield Research. “Across the board, higher costs for labor, chemicals, and materials have been among the most cited reasons for water utility rate increases,” he added.

Meanwhile, the impacts of climate change and extended drought in the western US further exacerbated the problem in California from 2020 through 2022, which is still recovering from those severe drought conditions and are just now finally seeing some relief after the past couple months of heavy precipitation across the state.

The increased costs of supplying water, making capital improvements to aging infrastructure, and delayed recognition of revenue increases due to postponed rate adjustments, have all led to higher operating and capital costs for AWR offsetting any improvements to future revenues to be recognized from any approved future rate increases.

In fact, the SA Quant system just issued a warning to avoid AWR:

American States Water Company has characteristics which have been historically associated with poor future stock performance. AWR is overpriced and has decelerating momentum when compared to other Utilities stocks, to the point that it gets a Sell rating from our Quant rating system. Stocks rated Sell or worse by our Quant rating system have massively underperformed the S&P 500, as this article will describe. The company has EV / EBITDA of 17.18 while the Utilities sector median is 10.82.

Peer water utilities such as California Water Service Group (CWT) also show a similar warning and should be avoided at this time as well.

Seeking Alpha

Other water utilities that are not based in California are doing better and should be considered as an alternative to AWR if you are seeking alpha from a water utility investment. My recommendation would be to consider CWCO as the best option for investing in a water utility in the current environment.

AWR Peers (Seeking Alpha)

In conclusion, despite the long track record of annual dividend increases making AWR a Dividend Champion (even a Dividend King) with 69 consecutive years of increases, the stock is not a good investment at the current valuation and given prospects for little to no earnings growth in the next 5 years. If you already hold shares of AWR, I do not recommend selling and you may wish to continue holding and just DRIP the shares to reinvest at lower prices to reduce your cost basis. If you are looking for a new investment in a water utility, there are better choices available.