Ghing

Introduction

As a dividend investor nothing excites me more than a company that’s considered an essential business that pays a growing dividend. Especially, when it’s a company that’s not super popular amongst investors. At least not here on Seeking Alpha. Case in point: Casey’s General Stores (NASDAQ: CASY).

This company was brought to my attention by a relative who’s travels quite frequently throughout the United States as a truck driver. We were having a phone conversation, and he mentioned the company and it instantly peaked my interest.

Right after I quickly researched them I thought to myself: This is a company I would invest my money in. If you follow me or are a frequent reader of my articles, then you know I often write on companies I own, would own, or would like to own someday. And in this article, I discuss reasons why dividend investors should consider owning Casey’s General Stores.

Who Is CASY?

Until recently I wasn’t very familiar with Casey’s General Stores. That’s because the company is mainly located in smaller towns in the Midwest region part of the United States.

Although I’m from a small town, we didn’t have a Casey’s or any national brand of convenience store for that matter. And throughout my 21-year military career, I was stationed throughout the Western part of the United States. Mainly Southern California, where I now reside.

One reason for that is the company’s footprint is mainly located in states like Texas, Oklahoma, Iowa, Illinois, and Indiana to name a few. Texas being the most recent state the company entered. But as seen in the chart below, CASY is the third largest convenience store chain and fifth largest pizza chain in the U.S.

CASY investor presentation

The company was founded in 1959 and is headquartered in Iowa with the first store opening in 1968, 56 years ago. Iowa is also the birthplace of my partner. I asked her about the company and the first thing she stated was: They have great pizza!

Small Town Advantage

To be honest, the company reminds me of a baby Kroger (KR), another company I like and own in my portfolio. The company prefers to operate in smaller towns with 50% of their stores located in towns with 5,000 people or less. So, if you’re not from the Midwest or a very small town that may be the reason for your unfamiliarity with the company.

Currently, the convenience store chain has 2,500 locations in 17 states. So, not a huge footprint compared to the more well-known 7-Eleven, who you can find almost anywhere you go. But being located in smaller towns is not only good for residents, it’s good for the company as well.

One reason being it’s cheaper to build, buy, and operate due to their geographic locations. Being located in larger, more well-known cities comes with advantages, but also higher costs. For customers it’s better because they typically enjoy lower prices than national brands. Additionally, their locations allow the company to resonate with locals more, which likely drives more loyalty from customers.

Long Dividend Track Record

The company has a pretty impressive dividend streak with more than 30 years without a reduction and even increased it during the Great Financial Crisis. And seeing by the company’s financials, the dividend remains safe and likely to grow for the foreseeable future.

They raised the dividend by double-digits in 2023 from $0.38 to the current $0.43 but still currently yield less than 1%. And this is well-covered by growing, stable cash from operations and free cash flow. Cash from operations grew roughly 10% from FY21 to FY23, while free cash flow grew roughly 12% during the same period.

Free cash flow during the latest quarter was $146 million, up from $115 million a year prior. So, despite the challenging backdrop, CASY managed to grow their free cash flow by nearly 27% year-over-year.

Cash from operations also grew to $253 million for the quarter and was up in the 6 months ended from $290.4 million to $328 million. EPS for the quarter was $4.24, significantly out-earning the regular dividend. This was also up double-digits from the year prior at 16%.

In one quarter, CASY out-earned the annual dividend payout of $1.72 by a sizable margin, giving them a very low payout ratio. This is something I like to see from dividend paying companies as it not only gives them room for further increases, but a lower risk of the dividend being cut if the company faces temporary financial hardship.

Their free cash flow payout ratio is also conservative giving them a (payout ratio) in the teens at less than 11% considering the 37 million shares outstanding. This means the company only needs roughly $16 million in free cash flow currently to cover the dividend and roughly $64 million on an annualized basis.

Over the last 3 years the company has brought in $410 million in free cash flow on average, so they have plenty of room to continue growing the dividend. And this is expected to be $1.25 billion by FY2026, more than double in roughly 2 years.

Buybacks & Low Leverage

One way they can continue growing the dividend for the long term is by buying back shares. Not only will this give CASY room to grow the dividend, but also increase earnings over time as well. In Q2, they bought back $30 million worth of stock and had $340 million remaining on the current share repurchase program.

And seeing by the ample free cash flow the company has, it’s safe to say buybacks will be a part of Casey’s future for a while. They also remain in a strong financial position by their low-leverage ratio of just 1.6x. This is in comparison to Kroger who had a ratio of 1.4x at the end of their recent quarter. Both are well-below the considered safe range of 3x for food retailers.

Furthermore, the company has no debt maturing until FY26 and their total debt stood at only $1.6 billion at the end of the second quarter. This is also down slightly year-over-year. They also managed to increase their cash on hand to $409.9 million according to their 10-Q and had a total liquidity of $1.3 billion.

Financial Flexibility For Growth

Most companies plan to continue growing the business not only for their shareholders, but for the sake of their financials as well. And one way to make sure of that is by maintaining a strong, healthy balance sheet. And as seen by Casey’s balance sheet, the company remains in a strong position for further growth.

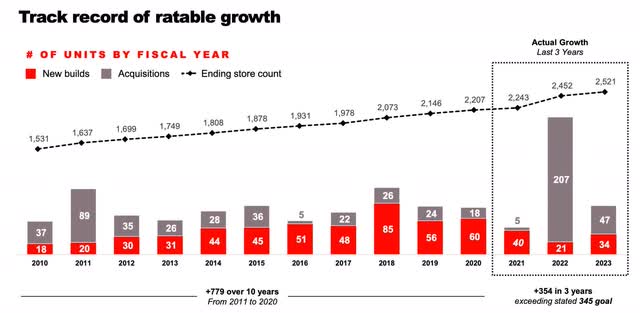

Over the years, CASY has expanded its store count with acquisitions and new builds showing no signs of slowing down in the future. In the last 3 years you can see they’ve made nearly double the acquisitions than they did in the last decade combined. They also plan to build 150 additional stores this year and 350 by fiscal year 2026. And if so you can expect the company’s top & bottom lines to reflect this growth going forward.

CASY investor presentation

Valuation

Using the EPS consensus of $12.85, this gives CASY a forward P/E of 22.5x. This is less than the 5-year average of roughly 24x, so long-term investors are getting a decent entry price. Since popping up from October at roughly $240 a share, the stock has been trading in a range of $275 – $285 a share. And although it trades close to its 52-week high of $291, I still think the stock is a buy here, especially if you’re a long-term investor like myself.

Furthermore, the current forward P/E is significantly higher than peer Kroger’s roughly 11x and Albertsons Companies (ACI) less than 8x. But the pending merger between the two companies could have an impact on the current share prices at the moment with the uncertainty surrounding the FTC’s decision, which is scheduled soon. With this considered, I think it still speaks to the quality of the company.

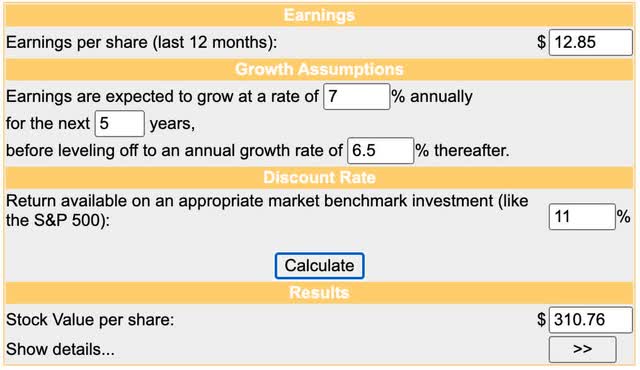

Using the Discounted Cash Flow Model, I have a price target similar to the average price target of analysts at nearly $311 a share, slightly above the $309 price target for Wall Street. This gives investors some decent upside. But if you want a greater margin of safety, you may consider adding on any market volatility or share price weakness.

moneychimp

Risk Factors

A risk for CASY is if the economy goes into a recession. Some are calling for an uptick in unemployment and job losses in the near future. If so, CASY could see a decrease in foot traffic at its locations which would likely have an impact on company financials. And although they’ve enjoyed some strong growth year-over-year, that was in an economy that saw strong job growth. A recession would also likely cause a slowdown in store growth as well, so investors looking to buy into the company should consider these risks going forward.

Bottom Line

Casey’s General Stores is a high-quality business that has been around for over a half of century. Additionally, they have a long track record of growing their dividend and show no signs of slowing down for the foreseeable future. Year-over-year they’ve shown impressive growth, despite the challenging environment many businesses have faced with higher interest rates.

Furthermore, they continue to grow their footprint with the recent move into the largest state by land mass, Texas. Due to their small-town advantage, I suspect the company’s financials will continue to show strong growth as they make acquisitions and increase their store count with new builds.

Their small-town locations also give them cheaper costs of capital in comparison to larger, more well-known peers and increased loyalty from customers. Because of their strong position financially due to their low-leveraged balance sheet, growing dividend, and growth outlook, I rate CASY a buy.