Bloomberg/Bloomberg via Getty Images

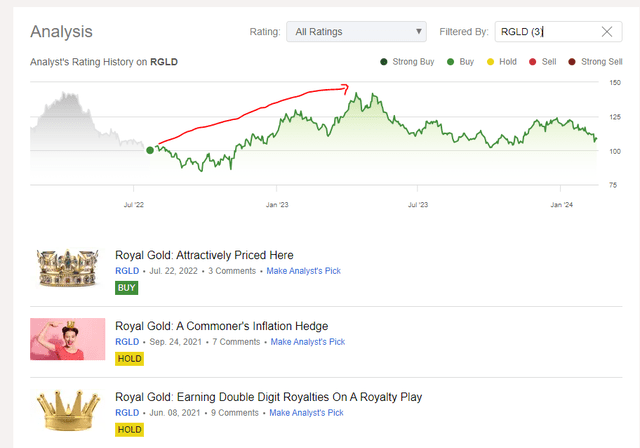

It has been some time since we wrote on Royal Gold Inc. (NASDAQ:RGLD). But the last time around, we gave it a Buy rating as the valuation was compelling. That call was a bit early, but those that entered there, had up to a 45% upside over the next 12 months.

Seeking Alpha

The stock has retreated back to close to that same point. We go over three reasons as to why this is a compelling buy. We also tell you why you need to have some dry powder to add one tranche 30% lower.

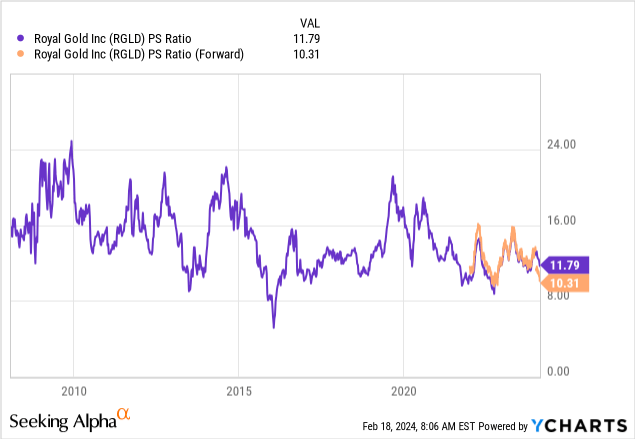

1) Superb Valuation

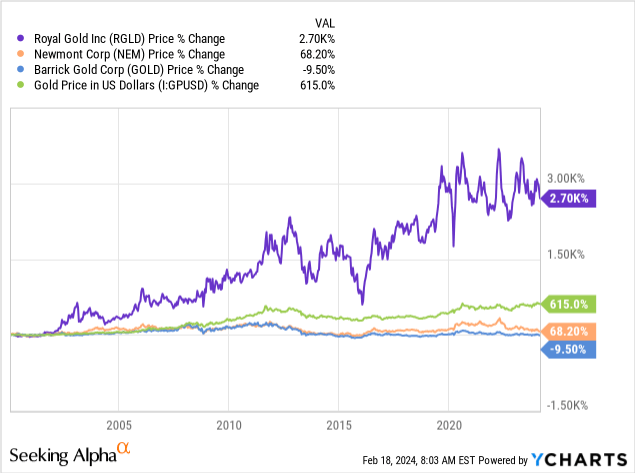

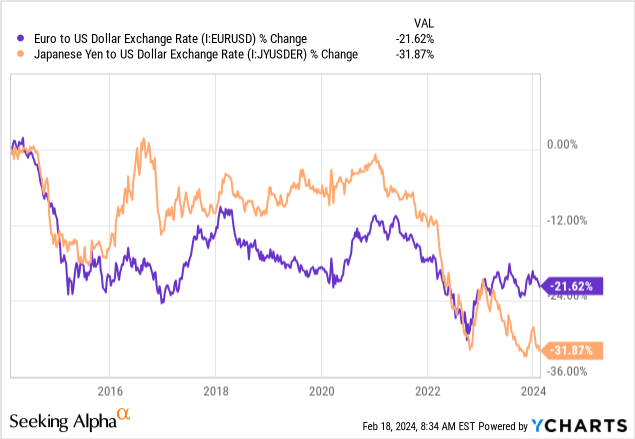

Our stance has always been that you have to pay up for the royalty plays. They are the only ones in the mining space that create value over the long run. Sure you can trade Barrick Gold (GOLD) and Newmont Mining (NO) and we are sure some will identify the exact 52-week lows as their buy point. But do they create compelling value in the long run? Well, we will let the next chart do the talking.

No. The answer is no, in case the chart was not emphatic enough. Coming back to RGLD, you have to pay more for these kinds of streams, and you won’t ever find them as cheap as the miners, for the preferred metric is close to 10X price to sales. If you get in there, your odds of success are high. On a forward 1-year basis, you are now in the zone.

We would pony up and buy.

2) Sentiment On Gold & Silver Is Horrid

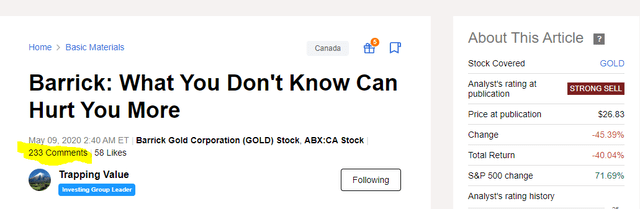

How do we determine sentiment? Well, there are many different measures. We can gauge some of it just by the comments on some of our articles. For example, our extremely negative article on Barrick was met with a lot of bulls hitting back. 233 comments in total. Barrick was roaring then, and the comments chastised us for taking a negative view.

Seeking Alpha

Our more recent piece, telling you that this one has low potential over the long run was more like Silence Of The Lambs.

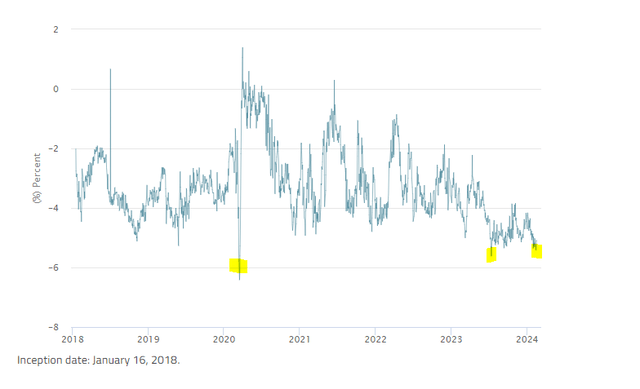

A better, non-subjective measure is the discount/premium on the Sprott Physical Gold and Silver Trust (CEF). We have written about this fund before and won’t go into details today, but its trading relative to NAV is the most important measure one can find. The current discount is now 5.11%, one of the highest in its history, only significantly exceeded during the COVID-19 crash.

Sprott

So while it may not prove to be the exact bottom for gold and/or silver, we know that sentiment is aligning well on our side for the underlying commodities and that improves our odds of success on RGLD.

3) The Man & The Legend Is Now Buying Gold Miners

We could have led this title with “Billionaire says”, but we only use that satirically. Nonetheless, we do think there is a small, added signal when Mr. Stanley Druckenmiller steps up to the plate. For those that do not know, Druckenmiller, also known as “The Druck”, is famous for many things including,

1) Not having a single down year (Source)

2) Compounding profits at a 30% annual clip in his hedge fund days (same source as above).

3) Breaking the Bank of England alongside his mentor George Soros (Source).

4) Making $260 million in 2008 (Source).

He has begun buying, though the bets appear to be modest at this point.

According to updated F-13 regulatory filings, Stanley Druckenmiller’s Duquesne Family Office dumped its holdings in Google’s Alphabet (GOOGL), Alibaba Group (BABA) and Amazon (AMZN) in the fourth quarter of 2023.As Druckenmiller has pared back his exposure to the tech and ecommerce sectors, he has placed new, albeit smaller, bets in the mining sector. The filings show the investment office bought 1.76 million shares of Barrick Gold and 474,000 shares of Newmont Mining. At the same time, they increased their exposure to Teck Resources (TECK), which represents the fifth biggest investment in the portfolio.

Source: Kitco

Now, of course, he has not bought RGLD, at least not based on the last 13-F, but his view on macro and sectors is what we are trying to discern. Almost all stocks in a sector follow where the sector ETF heads. So him loading up here on even the two mining companies, bodes well for RGLD.

Verdict

There are still two reasons here that we would not go full gung-ho on RGLD and the sector. The first being that we are still very bullish on the US Dollar. Our bullish stance on the US Dollar over the last few years (see, Three Reasons To Sell) has been in the minority and has panned out with the Greenback staying strong relative to Euro and Japanese Yen.

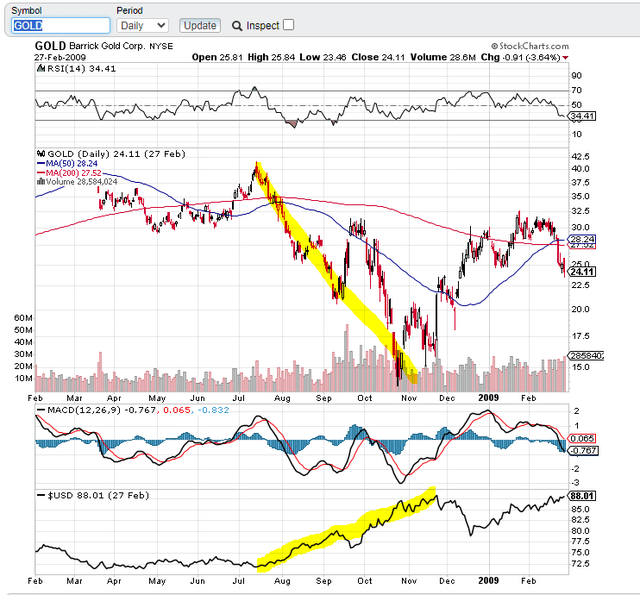

A further breakout will likely pressure gold and silver and in turn all the mining and royalty plays. In 2008, the first dip buyers were carted out as the US Dollar started its massive run.

Stock Charts

The second reason is that gold is still expensive relative to where the most correlated asset class stands today. So those are the cautionary tones, but we have enough evidence here to at least warrant an initial position. Some dry powder is best saved if we have a 2008 repeat. For now, we would not back up the truck, but just buy a little, like The Druck.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.