gsheldon

Founded in 1894, The Hershey Company (NYSE:HSY) stands as a global icon in the confectionery industry. Headquartered in Hershey, Pennsylvania, the company is renowned for its diverse range of chocolate and confectionery products, including the iconic Hershey’s chocolate bars. With a commitment to quality and innovation, Hershey has expanded its portfolio to include beloved brands such as Reese’s, Kisses, and Jolly Rancher. Beyond its sweet offerings, Hershey actively engages in sustainable and ethical practices, emphasizing cocoa sourcing and community development. As a leading player in the global sweets market, Hershey continues to delight consumers worldwide with its timeless treats and innovative creations.

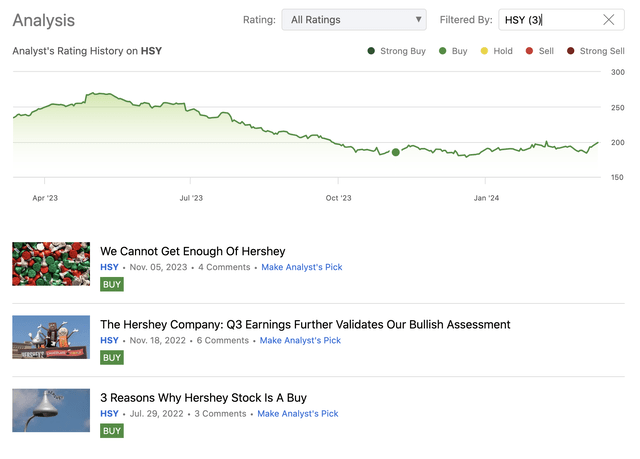

Commencing coverage in July 2022 with an initial “buy” rating, our stance on the firm has remained unchanged so far.

Analysis history (Author)

The following points encapsulate our bullish perspective over the past years:

Consistent and sustainable dividend payouts Robust financial performance A resilient and competitive business, underscored by strong profitability metrics Attractive valuation

Today, our objective is to reassess the validity of these factors and determine if a rating adjustment is warranted. To achieve this, our attention will be on the recently disclosed quarterly earnings (in early February), and the dynamics of profitability and valuation metrics.

Quarterly results

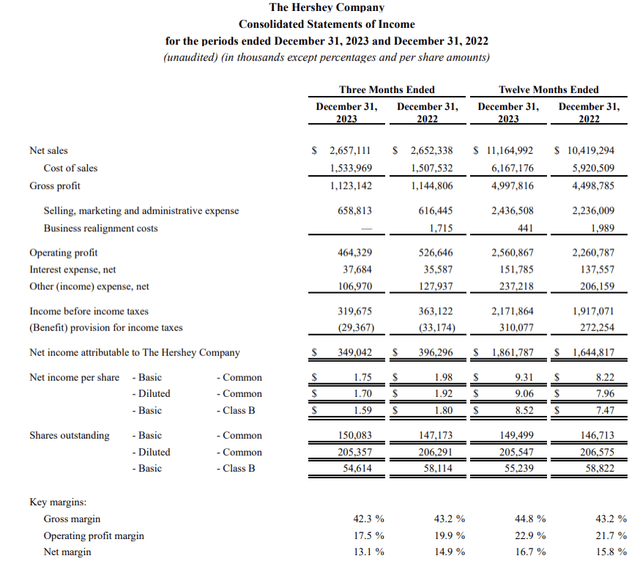

While in the full year of 2023 HSY has shown substantial growth across consolidated net sales (7.2% YoY), organic, constant currency net sales (7% YoY) and adjusted earnings per share-diluted (12.6%), in the fourth quarter of the year, the comparables have not been that impressive. In Q4 the firm has only achieved:

Consolidated net sales of $2,657.1 million, representing a mere 0.2% increase compared to the same period in the prior year Organic, constant currency net sales have even decreased slightly by 0.1%. Reported net income came in at $349.0 million, or $1.70 per share-diluted, representing a decrease of 11.5%. Adjusted diluted EPS were $2.02, in line with the prior year figure

Income Statement (HSY)

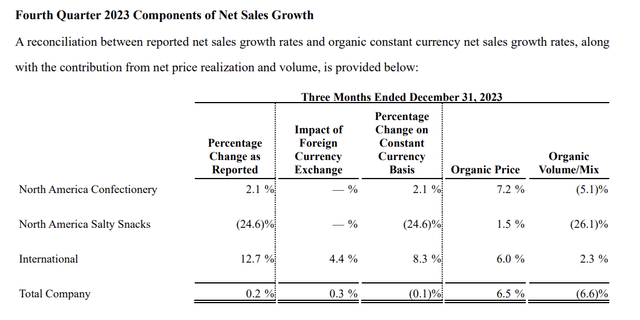

While there is a lot to take in here, we would like to point out the most crucial driver of the relatively soft results in the fourth quarter. And this is the North America Salty Snacks segment.

Results (HSY)

In Q4 2023, Hershey’s North America Salty Snacks segment reported net sales of $205.2 million, marking a 24.6% YoY decrease. The volume declined by 26.1%, mainly due to planned inventory reductions related to ERP implementation in October 2023, with an additional high-single-digit decline attributed to softness in the ready-to-eat popcorn category. U.S. salty snack retail takeaway dropped by 7.0% in the 12-week period ending December 31, 2023, influenced by a 12.9% decline in SkinnyPop ready-to-eat popcorn sales. Despite this, Dot’s Homestyle Pretzels retail sales increased by 6.8%, resulting in a 44-basis point pretzel category share gain. Segment income for North America Salty Snacks was $10.4 million, down by 81.7%, leading to a segment margin of 5.1%, reflecting a decrease of 1,570 basis points from the prior year. This decline in profit and margin can be attributed to volume deleverage, increased commodity costs, and higher investments in brand and capabilities, which more than offset lower manufacturing costs and increased productivity.

The outlook for 2024 also does not look much better than what we have seen in the fourth quarter.

Anticipating a net sales growth of 2% to 3%, the company attributes this increase primarily to net price realization. However, the outlook for reported earnings per share is expected to remain relatively flat. This is due to elevated cocoa and sugar costs, along with one-time expenses related to the Q2 ERP implementation and planned incremental cost savings initiatives. Despite the projected higher sales, price realization, productivity, administrative efficiencies, and a reduced tax rate, these factors are foreseen to be offset by the mentioned increased costs and one-time expenses. The company foresees adjusted earnings per share remaining flat when excluding the one-time costs associated with the ERP implementation and incremental cost savings initiatives.

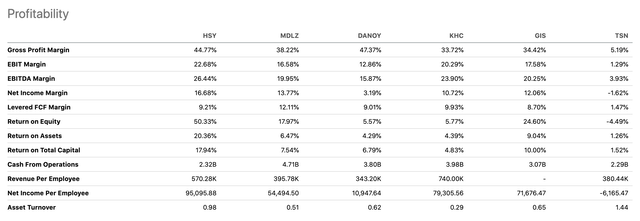

Important to note, however, that even with the contracted margins, HSY is attractive from a profitability point of view, if we compare it to its peers in the packaged foods and meats industry.

Comparison (Seeking Alpha)

All in all, the firm’s growth in the recent quarter has substantially slowed and there is little growth foreseen for the coming year. As the financial performance meaningfully worsened and the profitability of the firm has also deteriorated, we believe that our bullish view from this perspective is no longer justified. While many of the costs are one time expenses aiming to create savings in the future, we would like to see the strategy implemented and working, before we could again get bullish on the firm.

Valuation

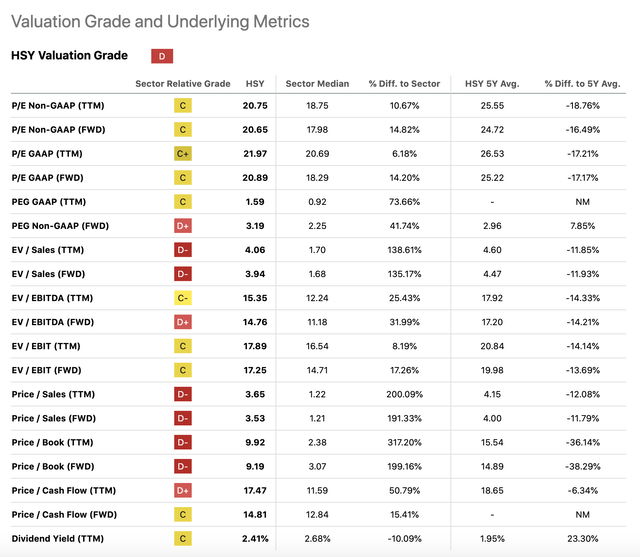

Now the question is, are the above mentioned headwinds and relatively weak outlook reflected in the stock price? To answer this question, we are going to take a look at a set of traditional price multiples, summarized in the following table.

Valuation (Seeking Alpha)

In our previous writings, we have always pointed out that HSY’s stock usually traded at a meaningful premium compared to the consumer staples sector median. Then we have argued that it is because of the firm’s outstanding profitability and growth. Now, that growth has slowed and profitability has somewhat worsened, the apparent premium is also significantly less. If we compare the current multiples with the firm’s own 5Y averages, we can see a more than 10% discount across most metrics.

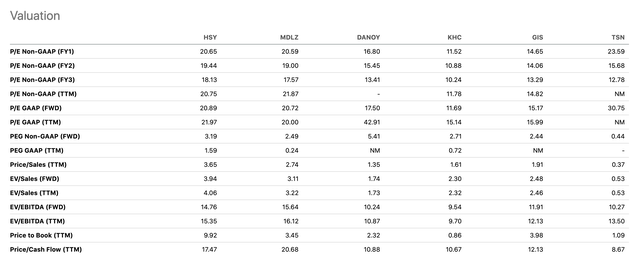

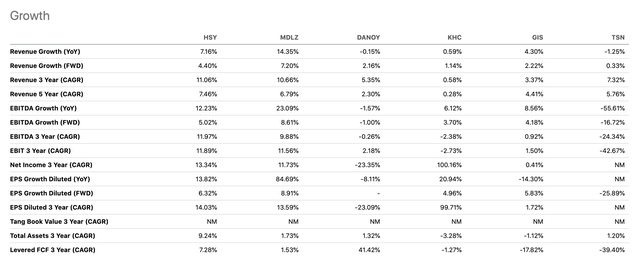

If we narrow down the peer group to HSY’s closest peers, we can see that the firm is not trading at unreasonably high prices.

Comparison (Seeking Alpha) Growth comparison (Seeking Alpha)

In sum, we believe that while the stock may not be overvalued right now, we would like to see the successful implementation of the cost savings strategy before we would be able to assign the stock a “buy” rating again.

Conclusions

The growth of the firm has substantially slowed in the fourth quarter, mainly as a result of the poor North America Salty Snacks segment. The ERP implementation in October, and the related inventory reduction as well as the soft demand for popcorn have been the primary drivers.

Due to increased SM&A expenses, the profitability of the firm has also deteriorated. However, we have to point out that many of the additional expenses are “one-time” in nature.

Looking forward, management also does not expect extraordinary growth in the coming quarters.

At the same time, the firm has remained committed to pay and even grow its quarterly dividends. The latest increase of 15% lead to a quarterly payment of $1.37 per share.

All in all, we believe that for these reasons our previous “buy” rating is no longer justified, and we downgrade HSY’s stock to “hold”.