IRS Direct File will be fully available to all eligible taxpayers in a dozen states on March 12, with a little over a month to go to file your federal tax return.

This story is part of Taxes 2024CNET’s coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

Direct File has had a conservative rollout by all accounts. The IRS launched its pilot for Direct File on Jan. 29, but only for a preselected group of government employees to file their taxes.

In the following weeks, taxpayers were able to sign up to use Direct File in waves, with the IRS making sign-ups for new users available in brief windows before closing it again. Now, the IRS is ready to take off the training wheels.

I got to test the software because I live in New York — one of the 12 states Direct File accepts federal tax returns from in 2024. Due to Direct File’s many restrictions around income, however, I wasn’t able to complete a return this year with the service.

But the free filing software is easy enough to use that I can see myself and others using Direct File in the future as the program expands the tax situations it covers. For now, it lags well behind industry leaders.

What’s it like to use IRS Direct File?

IRS Direct File is a clean and straightforward online tax preparation software. It’s bare bones. But what it does offer, it does well.

Before using Direct File, you’ll have to set up an ID.ME account to verify your identity. This preliminary process can be quite buggy. I experienced some difficulties with both uploading photos of my driver’s license and registering a selfie using the third-party’s technology. Logging on to Direct File with ID.ME after requires standard two-factor authentication using your phone.

Once you’re in Direct File, you’ll be greeted by a five-step tax-filing checklist: “You and Your Family,” “Income,” “Deductions and Credits,” “Your Taxes 2023” and “Complete.”

In You and Your Family, the software will ask you for your personal information, such as your home address, occupation and date of birth. Note that when entering your mailing address you can’t abbreviate words like street, drive or avenue commonly found in home addresses. This will trigger an error message.

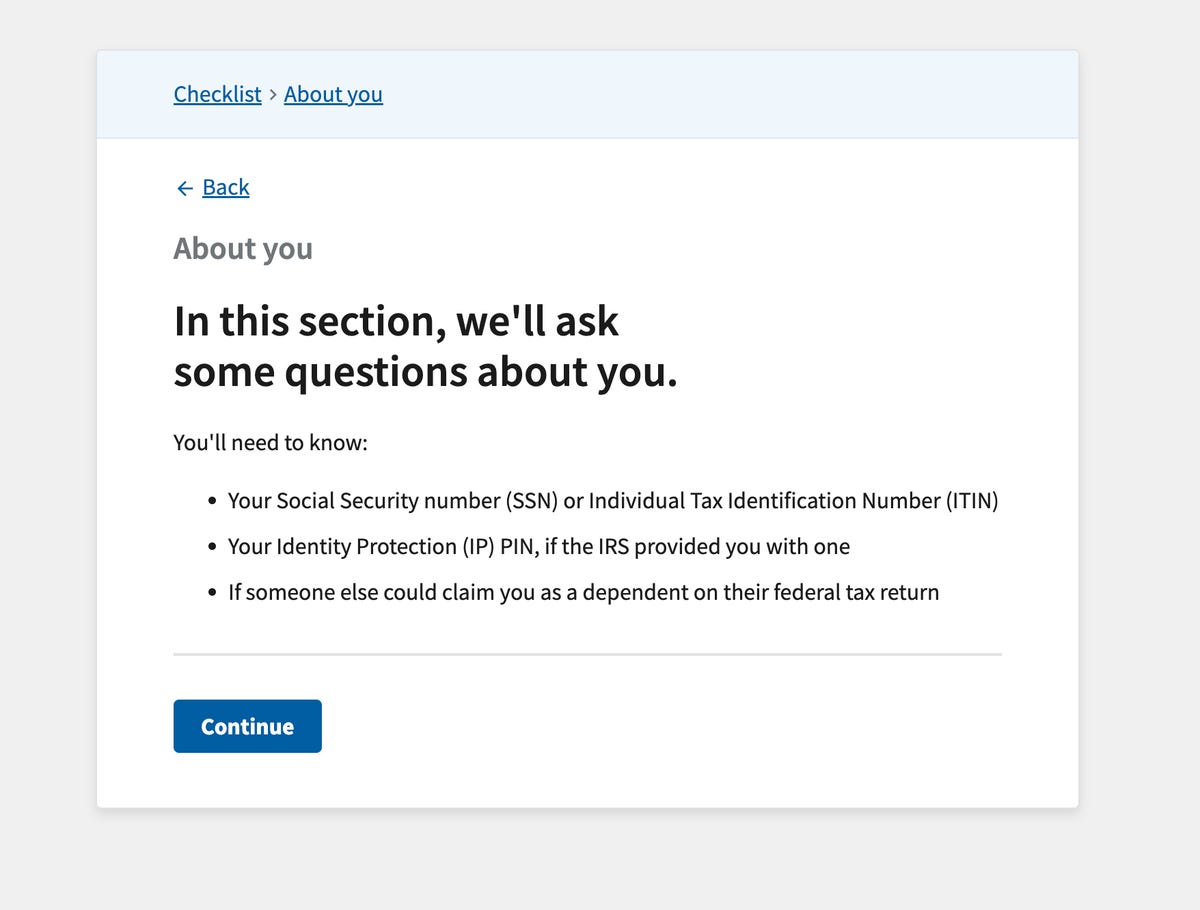

Each time you start a section, Direct File will preview the information it asks you for. You’ll also find hyperlinks that launch pop-up windows with contextual help as you go along. At the end of each section or form you add, Direct File will show you a recap of what you entered to check your work.

This is important because, with Direct File, you will enter most of your tax information manually. Only a few questions will be answered by clicking on drop-down lists or answering yes or no questions. It feels very much like FreeTaxUSA and Cash App Taxes in this way. There’s also no W-2 upload option or option to upload last year’s tax return to get you started.

The IRS has been forthcoming about Direct File’s limitations this year. The new program has a few major holes, including income caps and limits on the kinds of credits you can claim. Additionally, you can use this filing option only if you’re taking the standard deduction.

Two other glaring holes that Direct File makes very clear to the user as you complete your return is that the software accepts federal returns only from 12 US states — Arizona, California, Florida, Massachusetts, New Hampshire, New York, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. Direct File also only allows you to report income from a handful of sources:

Income from an employer (Form W-2)Income from unemployment compensation (Form 1099-G)Social Security or railroad retirement benefits (Form SSA-1099)Income of $1,500 or less from interest, US savings bonds or treasury obligations (Form 1099-INT)

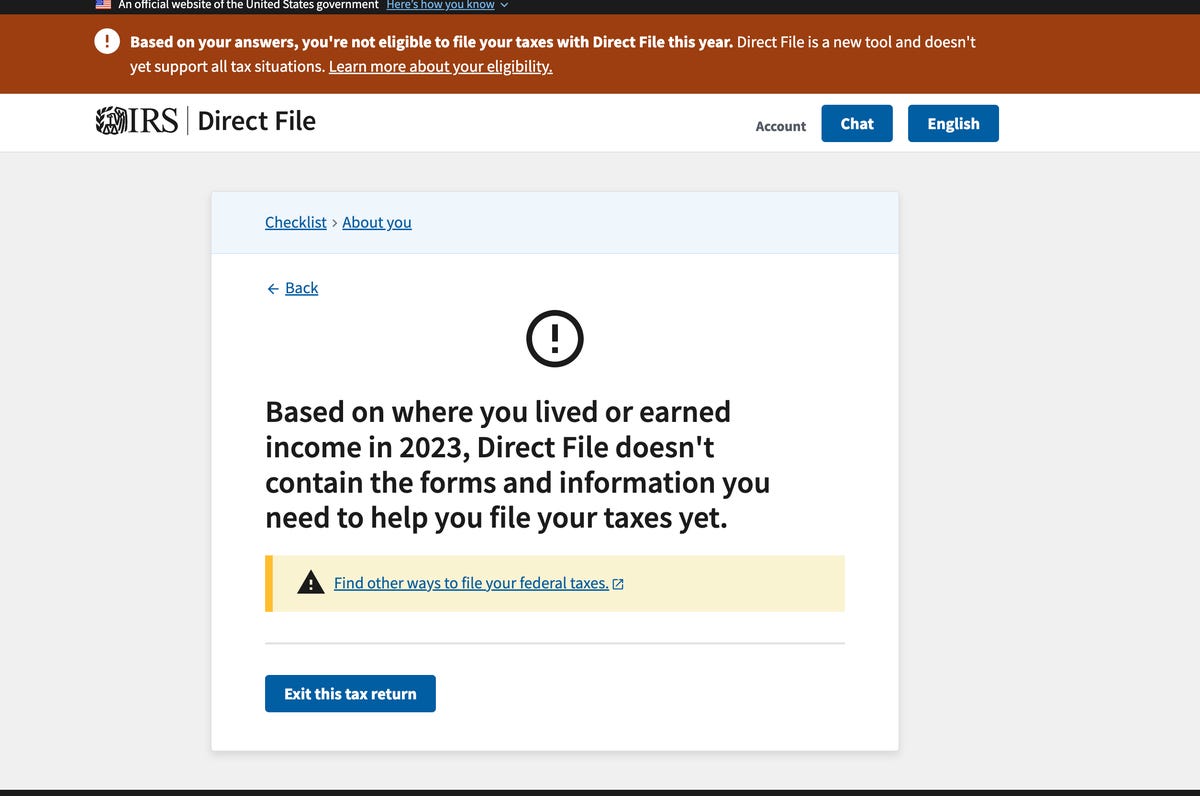

If your answers indicate that you live in a state outside of the 12 mentioned above or that you need to report income from an unsupported tax form, Direct File will show you a warning message with a link to this IRS page detailing other ways for you to file your taxes this year.

IRS Direct File also doubles down on making sure you don’t file an incomplete tax return. It asks you for your sources of income by tax form and also asks questions about your tax situation to make sure you have all the forms you need. Should one of the forms you need be a 1099-DIV, 1099-R or any other form not supported by IRS Direct File, you’ll receive a similar warning message.

While this extra step will feel a bit unnecessary to experienced DIY tax filers, it can be very helpful for newcomers. I’d even say it’s similar to TurboTax in the way it goes the extra mile to hold your hand in this scenario.

Once you’re ready to file your return, Direct File will show you a page with your total federal tax return or the amount you owe. I imagine it feels a little different when the IRS is telling you how much you owe, rather than a third party. Direct File also explains how the software calculated the number. If you’re getting a return, DIrect File lets you receive your refund through direct deposit or mail.

IRS Direct File’s other notable features

IRS Direct File’s contextual help is on par with most online tax preparation software. But its chat function is very limited.

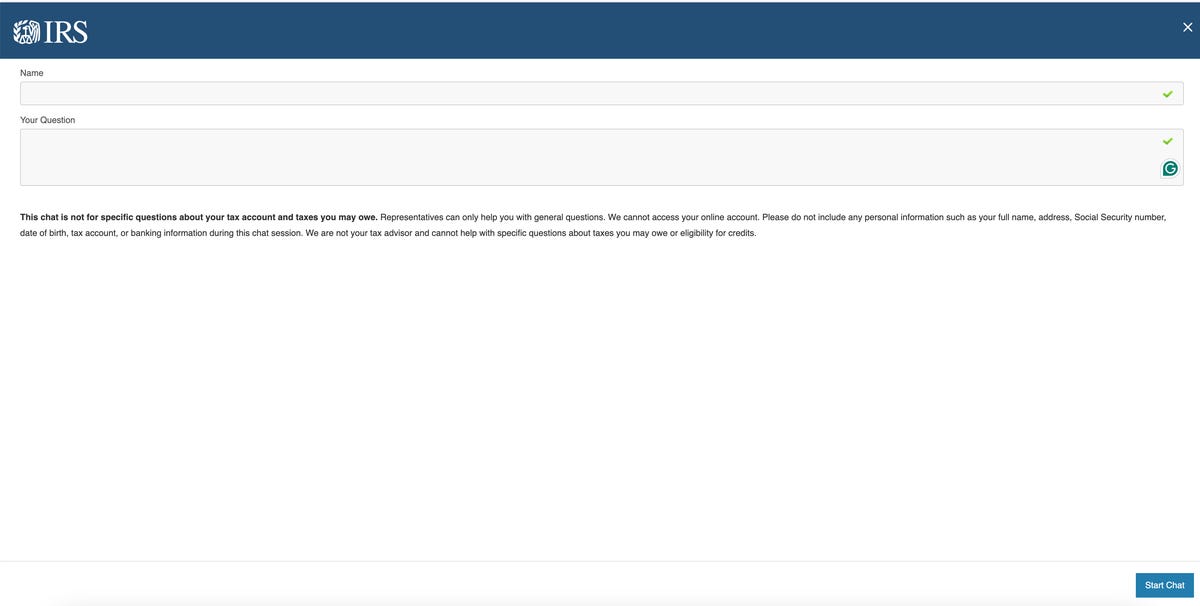

When you click on Chat on the upper-right corner of the screen, the software launches a new tab where you type in your name and a general question about using Direct File. You can’t ask a question about your tax situation, however. In fact, Direct File explicitly tells you not to include any financial information with your question.

“We are not your tax advisor and cannot help with specific questions about taxes you may owe or eligibility for credits,” the page reads. This is a great move on the part of the IRS to make clear to users that Direct File only serves as a tax preparation service.

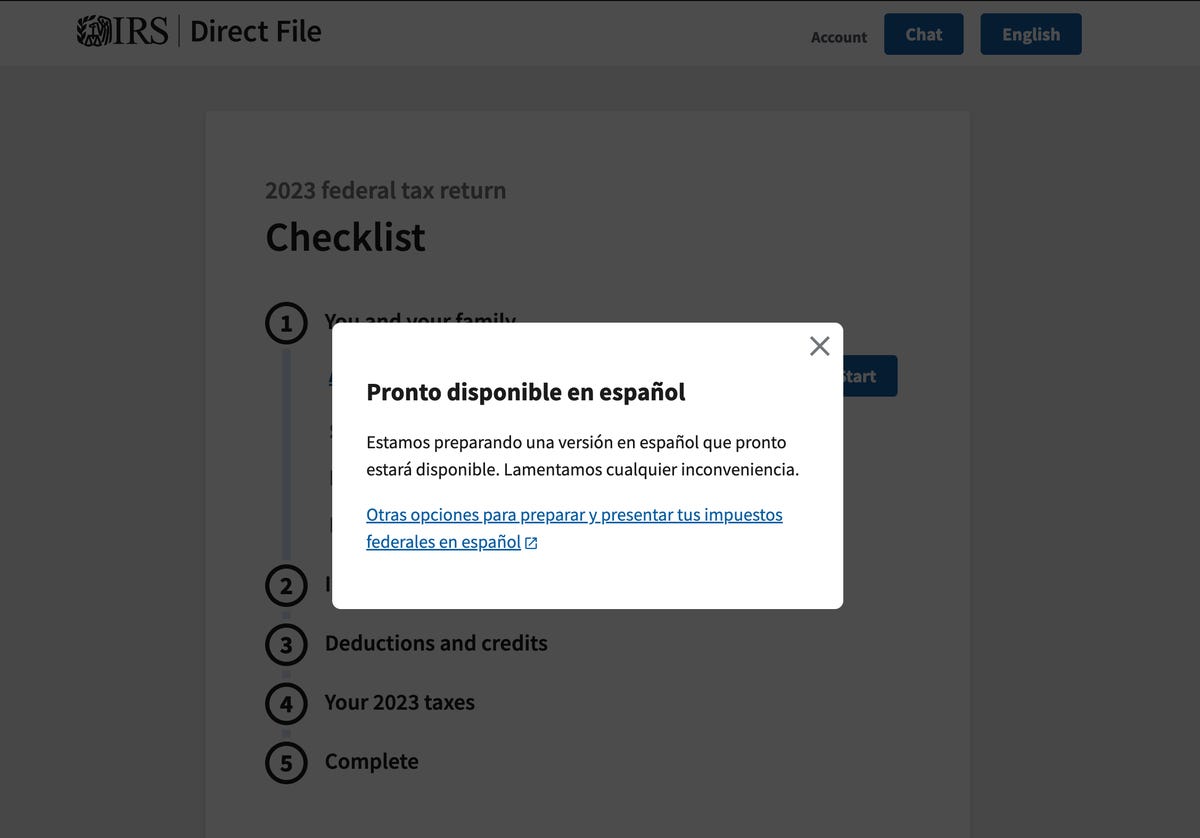

IRS Direct File is available only in English for now. But the agency is also working to develop a version in Spanish. The software currently lets you toggle between English and Spanish, which triggers this pop-up explaining that the latter is coming.

What’s missing from IRS Direct File?

Upon testing IRS Direct File, I came away impressed with how smooth the software is to use. The service offers clear direction and gives you a good sense of how close you are to completing your return.

But there are some missing components that I expected to see as part of the rollout. For starters, it should have a widget at the top of the screen that updates the size of your return or the amount you owe as you enter your tax information. It seems like every online tax filing software program has this. Direct File should too.

Direct File forces you to fill out your tax return in a specific order. While you can go back to any part of your return you’ve completed via the checklist, you can’t skip ahead to deductions and credits, for example. Not every online tax filing software allows you to skip forward, but I’m a big fan of the ones that do.

One thing that surprised me was that Direct File doesn’t integrate the IRS’s full library of tax resources either. I was fully expecting to see a designated “Help” tab for me to reference as I tested. After all, the IRS helps taxpayers “understand and meet their tax responsibilities and enforce the law,” according to its website.

The contextual help built into the tax software is solid, but in our opinion IRS Direct File should be the online tax software with the best contextual help and resources. It still can be in the future. Currently, that designation goes to TurboTax, H&R Block and FreeTaxUSA.

Finally, the IRS has a big opportunity in the coming years to integrate users’ tax and personal information into Direct File. With such a conservative and careful rollout in year one, this probably wasn’t feasible in 2024. But because the IRS already receives tax forms from your employer, I can reasonably see a future where your basic personal information and W-2 is automatically presented to you after creating an account. The integration would give Direct File a competitive edge in the market, in addition to its free price.

Is IRS Direct File Right for me?

IRS Direct File isn’t a good fit for most people this year. That’s not because of how the tax software performs, but rather due to the guardrails put in place by the IRS, such as the fact only eligible taxpayers in 12 states can use the program this year.

But if you live in one of those 12 states, such as New York or California, have only a W-2 and a 1099-INT to report, and will claim the standard deduction, there’s a great chance that you do qualify. Be sure to compare your tax situation to the forms and schedules IRS Direct File accepts this year.