PM Images

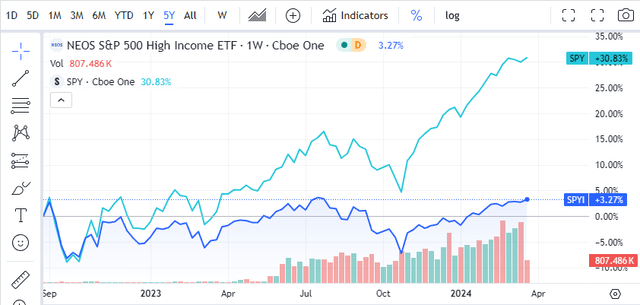

The Neos S&P 500 High Income ETF (BATS:SPYI) is getting a lot of attention from investors as its assets under management (AUM) have grown from $314.37 million on 9/20/23 to $946.55 million over the past 6 months. Shares have been up 2.87% since 9/20/23, and the AUM has basically tripled. I added SPYI to my Dividend Harvesting Portfolio Series on Seeking Alpha (can be read here) last year, and I was pleasantly surprised by its performance. I think that the team at Neos created a solid product that is delivering on its investment goals. I think the market is going higher in 2024, and investing in SPYI should allow me to generate ongoing income while participating in the upside if we get a strong rally at the end of the year. As we can see in the chart below, SPYI isn’t going to replicate what the market does, but it has followed the trend to a degree. If you’re looking for a vehicle that will deliver pure capital appreciation during a bull market, then SPYI isn’t necessarily a product that will be of interest. If you’re looking to take the work out of the equation and invest in a fund that is actively managed by implementing a unique option overlay strategy to generate monthly income and capture some appreciation, then SPYI may be something that should be looked at in-depth. I am planning on adding more to my position before the summer.

Seeking Alpha

Following up on my previous article about SPYI

My last article on SPYI was published on 9/20/23 (can be read here), and since then, the popularity of SPYI has increased significantly. The total AUM has tripled as share of SPYI has appreciated by 2.93%. From an appreciation standpoint, SPYI has trailed the S&P 500’s appreciation of 15.64%, but when the distribution income is factored in, SPYI’s total return is 8.23%. In my September article, I discussed the overall strategy that NEOS has implemented and why I was a fan of the ETF. Now that we have more economic data and there seems to be much more interest in SPYI, I wanted to revisit my investment thesis and discuss why I think it’s a solid income investment going forward.

Seeking Alpha

Risks to my investment thesis in SPYI

When it comes to SPYI, I believe there are risks to my investment thesis as well as risks to the individual investor. I don’t think anyone should solely make an investment based on commentary from one of the major financial news networks or an article they read online. One of the biggest risks on an individual basis is not understanding the investment or doing an adequate amount of due diligence. Anyone who is interested in SPYI should not just look at the yield; read through the prospectus and gain an understanding of the investment product. A major risk, regardless of whether it’s an individual equity or an ETF is not understanding what you’re investing in. From an actual investment standpoint, the amount of income generated from the distribution isn’t guaranteed. If option premiums soften then the monthly distributed income will decline. While SPYI invests in companies within the S&P 500, its downside isn’t mitigated, and the price fluctuation will be dictated by the market. SPYI could experience moves to the downside during periods of volatility. There is also opportunity cost involved as SPYI utilizes an option strategy that has multiple components to generate income and capture some upside appreciation based on the market’s direction. This could lead to an investor underperforming the market.

SPYI is bridging the gap between a traditional covered call ETF and the S&P 500

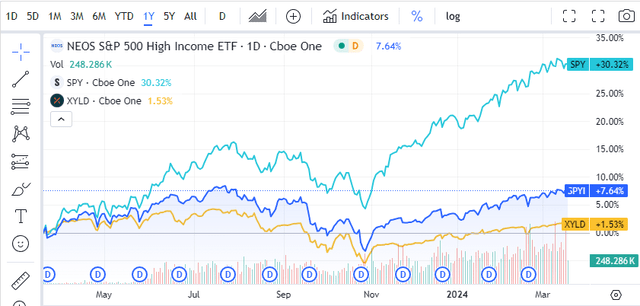

Investors who place an emphasis on generating income often have goals different from those trying to generate capital appreciation. This doesn’t mean that there can’t be a hybrid solution that bridges the gap between the two. Global X was a pioneer in the covered-call ETF space with the Global X S&P 500 Covered Call ETF (XYLD), which invests in all the companies within the S&P 500 while writing covered calls against the portfolio to generate income. There is no correct way to invest, as everyone’s investment strategy is unique, and their overall goals vary. XYLD has stayed true to its roots by writing at the money covered calls to generate monthly income, but its overall upside is capped in return.

The team at NEOS developed a strategy where they are investing in the companies within the S&P 500 just like XYLD does but have a 2-leg approach to their option strategy. In the 1st leg, NEOS takes in premium from writing covered calls on their portfolio. NEOS utilizes that premium to pay the monthly distribution while conducting the 2nd leg of its option overlay strategy. In the 2nd leg NEOS purchases call options on the S&P 500 index with the remaining premium to uncap its upside potential to a degree. When a covered call is sold against a position, the entity that writes the covered call is selling the right to purchase their shares at a specific price on a specific date. If shares appreciate past that price, the entity that wrote the contract is not entitled to any upside past the agreed price in the contract. By purchasing call options with the remaining premium, SPYI is allowing its investors to participate in some of the upside if a rally occurs in the market.

Looking at the chart below, the SPDR S&P 500 Trust (SPY) has appreciated by 30.25% over the past year. XYLD, a straight covered call ETF, has appreciated by 1.53% over this period while paying out $3.94 of distributed income, a 9.91% yield on capital from the $39.77 shares traded for on 3/20/23. SPYI on the other hand, able to generate a return of 7.64% in the same period while paying investors $5.83 in distributed income, which was a 12.5% yield on capital as shares traded for $46.63 on 3/20/23. Based on the data, SPYI is able to generate more alpha than a traditional covered call ETF because of the 2nd leg of its option overlay strategy, but it still will typically underperform the market during uptrends as a portion of the upside is capped to a degree.

Seeking Alpha

I think the market is going higher in 2024 and SPYI can continue to bridge the gap and generate substantial income with some appreciation

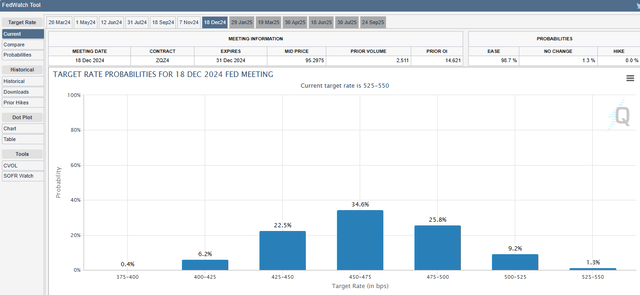

Goldman Sachs (GS) has increased its S&P 500 target to 5,200 by the end of 2024, while Bank of America (BAC) has boosted its target on the S&P 500 to 5,400. Today, the S&P 500 is trading at around 5,170, which is up roughly 8.42% YTD. It will be interesting to see what Fed Chair Powell says at this month’s FOMC meeting and the tone regarding rates. The CME Group is expecting that there is an 89.5% chance that rates finish below 5% in 2024, with the largest probability that the Fed Funds rate will be between 450-475 bps. If the Fed starts to cut rates, I think that we will see the market go higher as the cost of capital declines and businesses are more likely to expand.

CME Group

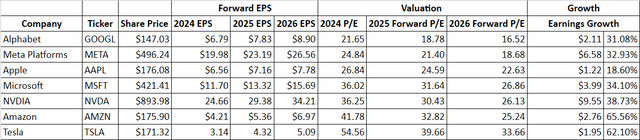

Below I compiled the Magnificent 7’s forward earnings estimates from Seeing Alpha. The Magnificent 7 is currently trading at an average of 34.59 times 2024 earnings, and over the next 2 years, the average earnings growth these companies are projected to experience is 40.44%. Based on 2026 earnings, the Magnificent 7 trades at 24.25 times. I feel that this is an indication that companies and individuals will be spending more money throughout the economy over the next several years, and if that is true, I expect the broad market to increase their EPS over the next several years. If this occurs, I think it will be beneficial for SPYI as it owns all of the companies in the S&P and will typically follow the market direction.

Steven Fiorillo, Seeking Alpha

Conclusion

I believe we’re headed into a multi-year bull market which will be led by big tech. If the Fed starts the rate-cutting cycle over the next several months, I think more companies will project for higher earnings, which could lead to additional upgrades and S&P target increases from The Street. If this occurs, I think SPYI will follow the market higher while continuing to generate monthly income from its covered call overlay strategy. SPYI could be a hybrid fund that allows income investors to meet their initial investment goals while providing a vehicle to capture some appreciation at the same time. I am bullish on the market and SPYI for 2024.