the gap

In November, I penned an article titled “Looking Forward To 2024” on Alphamin Resources (TSXV:AFM:CA), as the company had a number of catalysts coming to fruition in the new year.

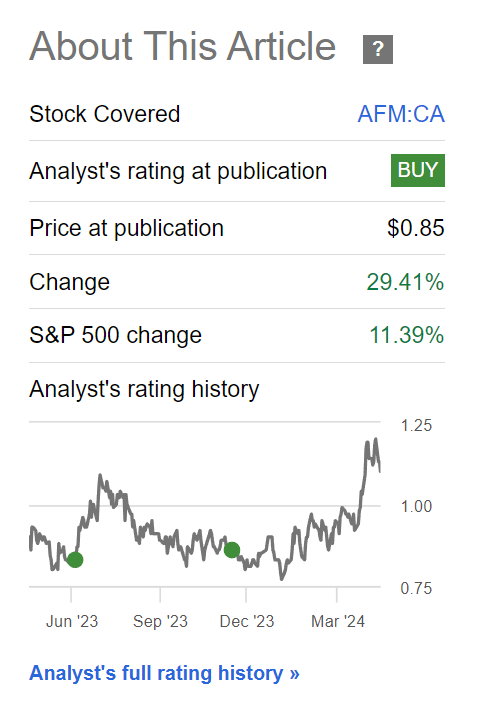

So far, my patience has been well rewarded, as Alphamin’s shares have rocketed higher by almost 30% (Figure 1).

Figure 1 – Alphamin has rallied close to 30% (Seeking Alpha)

Was the recent run-up in Alphamin’s stock price driven by the catalysts I had previously identified and are there still more upside to come?

Brief Company Overview

For those new to the company, Alphamin Resources is a Canadian tin producer with mining operations based in the Democratic Republic of Congo (“DRC”). Its flagship mine is the Bisie Tin Mine (“Bisie”), with the highest known tin grade of any operating mine (Figure 2). Based on this single asset, Alphamin is currently producing ~4% of the world’s tin supply. This figure is expected to expand to ~7% once the Mpama South expansion is completed in early 2024.

Figure 2 – Alphamin overview (AFM investor presentation)

Tin Is The Forgotten Energy Transition Metal

Tin is often called the forgotten transition metal because investors and policymakers narrowly focus their attention on the ‘sexier’ metals like copper, lithium, nickel, and cobalt when they talk about the energy transition. Hardly anyone gives a second thought to tin, the primary ingredient in solder that holds all those electrical components together.

2024 Starting Off On The Right Foot

Back in November, I had noted that Alphamin was facing some operational issues, as torrential rains have led to poor road conditions in the DRC, impeding the company’s ability to import key materials for the construction of Mpama South expansion and export the mine’s production.

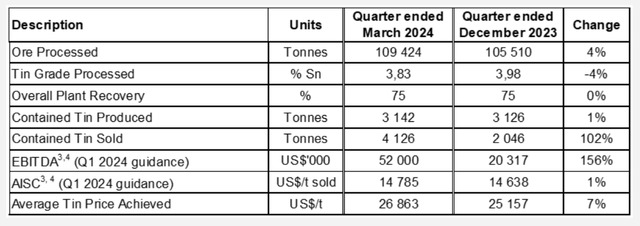

Poor road conditions led to a reduction in Q4/23 tin sold to just 2,046 tons, about 2/3 of the normal volume, and a reduction in the company’s EBITDA to just $20.3 million (Figure 3).

Figure 3 – Alphamin Q1/24 operational overview (AFM press release)

Fortunately, throughout the operational hiccup, mine operations continued to perform well, with ore processed and tin produced well within historical norms.

Furthermore, road conditions have since improved in the first quarter, and Alphamin recently announced that the company was able to clear the backlog of mined but unsold tin, resulting in tin sales of 4,126 tons and an estimated EBITDA of $52 million for Q1/24.

Investors like myself likely breathed a sigh of relief on release of the Q1 guidance, as there were some concerns that the poor road conditions would persist.

Mine Development Slightly Delayed

With respect to development at South Mpama, commissioning of the processing plant is a few weeks behind schedule and Alphamin will not meet its target of first production in early April. However, this is normal for complex mining projects and should not be a major concern, as I was already expecting a slight delay due to the poor road conditions mentioned above.

According to the company’s latest update, the Mpama South underground development continues to be on target and the mine has already stockpiled 5,300 tons of crushed ore that is ready to be fed through the processing circuit.

One note of caution is that a mechanical unit in the crushing unit had recently failed – a brand new machine should not fail within months of installation. Representatives from the OEM are on site investigating the failure and Alphamin has replacement spares for this unit, so ramp up for Mpama South should not be affected. However, this is something investors should monitor going forward.

Tin Prices Waking Up From Its Slumber

The catalyst that I am most excited about is tin prices, which have been rising rapidly in the past few months to a recent high of over $35,000 / ton (Figure 4), tracking the surge for other base metals amid concerns about supply.

Figure 4 – Tin prices have been surging (tradingeconomics.com)

For Tin, the recent supply issue has been Indonesia. Indonesia produces about ~20% of the world’s tin, but the country recently saw exports ground to a halt as a change in the country’s permitting system have disrupted the export of the critical material. This compounded mining disruptions in Myanmar.

On tin demand, a rebound in Chinese and American manufacturing activities, per their respective PMIs, have led to a surge in demand. This supply/demand dynamic has led tin inventories at the LME to decline by almost 45% YTD to 4,245 tons.

Macquarie, a global investment bank with a specialty in resources, expects a global tin deficit of 8,000 tons this year and 12,000 tons in 2025, reversing last year’s 8,000 ton surplus.

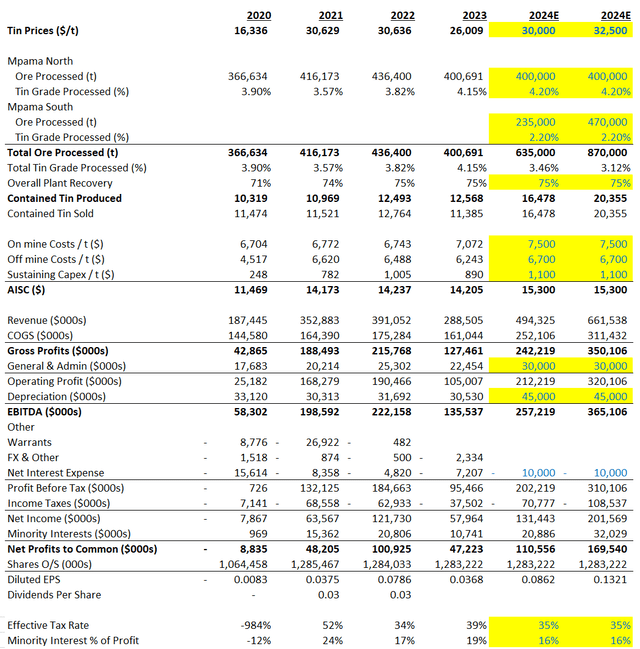

Updated Financial Model

Putting it all together, I believe Alphamin could get a double tailwind of improving tin prices and increased production volumes in 2024 and 2025. Assuming tin prices of $30,000 in 2024 and $32,500 in 2025, plus production at Mpama South beginning in the second half, I see Alphamin earning $0.086 / share in 2024 and $0.132 / share in 2025 (Figure 5). This would be more than a double and triple in earnings compared to 2023’s $0.0368 / share.

Figure 5 – Updated financial model (Author created)

In fact, there is reason to be optimistic, as Alphamin was only producing from Mpama North in 2022 when prices were $31k / ton and delivered $0.0786 / share in earnings. If costs come in better than my estimate, then earnings would commensurately increase.

Valuation Still ‘Dirt’ Cheap

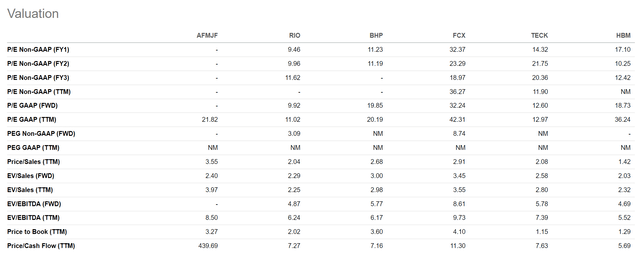

Looking at Alphamin’s valuation, I see the company trading at 9.4x 2024 Fwd P/E and 6.1x 2025 Fwd P/E, as the financial estimates above are in US dollars and Alphamin’s stock price is only US$0.81.

Compared to base metal peers like Rio Tinto and BHP, Alphamin definitely appears ‘dirt’ cheap (Figure 6).

Figure 6 – Peer valuations (Seeking Alpha)

The only caveat is that Alphamin is a single asset, single commodity producer in a tough mining jurisdiction, so its valuation may suffer a persistent discount.

Shareholder Returns Via A Dividend

However, stock appreciation is not the only way investors can benefit. Alphamin is also very shareholder friendly when it comes to returning capital, as the company paid a $0.03 / share dividend in each of 2021 and 2022. Although financial performance was not as strong in 2023, the company should still be able to pay a meaningful dividend, when it is decided at a board meeting later this month.

Furthermore, once Mpama South is fully ramped up, I believe Alphamin should be able to increase its dividend to an even higher rate.

Risks To Alphamin

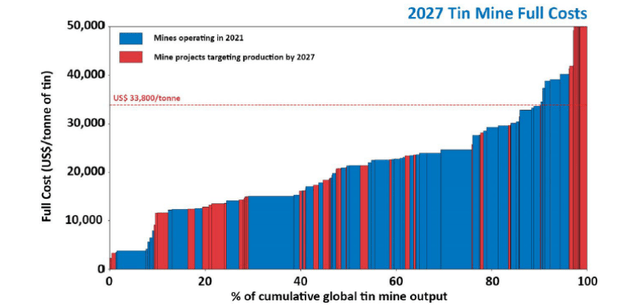

As we have mentioned previously, there are two key risks with Alphamin. First, Alphamin is a single commodity producer, so it is very exposed to tin prices. However, offsetting that concentrated exposure is Alphamin’s cost structure, with Bisie squarely in 1st quartile production costs (Figure 7). So Alphamin should be solidly profitable in most long-term price scenarios.

Figure 7 – Tin cost curve (AFM investor presentation)

Another risk to Alphamin is Bisie’s location in the DRC. The DRC is one of the toughest jurisdictions to operate mining assets as the country is politically unstable and corruption is rife. There is a reason leading Western mining companies like Freeport (FCX) have exited the country.

Conclusion

Alphamin has performed nicely since my last update in November, rallying close to 30%. I believe the future remains bright for the company, as operational issues with poor road conditions appear to be resolved and the Mpama South mine is ramping up. With tin prices also recovering, Alphamin could benefit from a double tailwind of increasing production and increasing prices in the next few quarters.

I continue to own shares and recommend Alphamin as a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.