ugurhan

By Warren Patterson

The risk of disruption to Middle Eastern supply grows

While price action in the oil market has been somewhat surprising following Iran’s attack on Israel, the risk of tensions in the Middle East impacting oil supply is certainly growing.

The lack of price strength following Iran’s recent attack is largely due to a large risk premium already having been priced into the market. ICE Brent rallied from a little more than US$86/bbl at the start of April to over US$90/bbl in anticipation that Iran would respond to Israel’s suspected airstrike on its embassy in Syria. Secondly, the market is also in limbo, waiting to see how Israel responds to the recent attack. The longer the market waits for Israel’s response, the more likely the risk premium starts to fade.

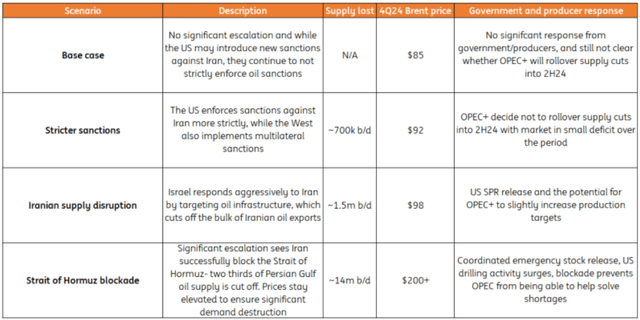

Risks to oil supply because of the ongoing tension in the Middle East are at their highest since October last year. Any further escalation would only bring the oil market closer to actual supply losses. We believe there are three key supply risks facing the oil market as a result of current tensions. These include stricter enforcement of oil sanctions against Iran, Israel retaliating by targeting Iranian energy infrastructure, and the worst-case scenario – that significant escalation eventually sees Iran attempting to block or disrupt oil flows through the Strait of Hormuz.

Potential scenarios and what these could mean for oil supply & prices

ING Research

Stricter sanctions enforcement

Israel’s allies are pushing for a diplomatic response to Iran’s attack, although it would appear that Israel is looking at a potentially more aggressive approach.

The US and Europe are looking at potentially imposing stricter sanctions against Iran following the attack. The US already has oil sanctions in place against Iran.

The issue is that the US has not strongly enforced these sanctions since Russia’s invasion of Ukraine, given concerns over oil supply and higher prices. As a result, the Iranian oil supply has grown from an average of a little over 2.5m b/d in 2022 to close to 3.2m b/d in March 2024. If the US were to properly enforce sanctions, it would leave around 700k b/d of supply at risk.

There is potential for further supply losses due to sanctions. Legislators in the US are considering a bill called the Iran-China Energy Sanctions Act, which would attempt to crack down on Iranian oil flows to China. There is also scope for the EU and other allies to agree on multilateral sanctions, which would only make it more difficult to move Iranian oil.

While new sanctions might be introduced, the key question is whether these sanctions will be more strictly enforced. There will be concerns over the potential impact supply losses could have on oil prices, and the Biden administration would not want to see higher oil prices and pump prices in the lead-up to US elections later in the year.

If we were to see stricter enforcement of sanctions, this is not something that will become immediately apparent to the oil market. It will take time for it to become noticeable in tanker tracking data.

Losing in the region of 700k b/d of Iranian oil supply would be enough to push the oil market into a small deficit over the second half of the year, which would imply ICE Brent averaging US$92/bbl in 4Q24 versus our current forecast of US$85/bbl for the final quarter of the year. This is under the assumption that OPEC+ decides against rolling over supply cuts into the second half of the year.

Iranian supply disruptions

With it still unknown how Israel will respond to Iran’s attack, we cannot fully rule out the potential for Israel to target Iranian energy infrastructure. Iran is an important oil producer, with it being the fourth-largest OPEC member, pumping close to 3.2m b/d. Any targeting of Iranian energy would likely provide a boost to oil prices.

We believe the likelihood of Israel targeting energy infrastructure is rather small. This would not go down well with allies, given the impact it would have on oil prices.

If we assume that the bulk of Iranian oil exports are halted, we could see Brent average a little under US$100/bbl in 4Q24.

Iranian escalation and the Strait of Hormuz

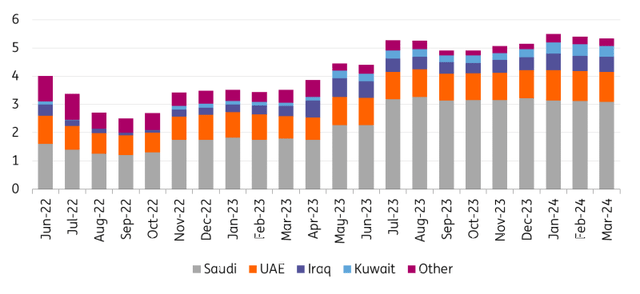

The worst-case scenario for the oil market would be if we saw escalation to an extent where Iran attempts to impose a blockade through the Strait of Hormuz. The Strait of Hormuz is the most important chokepoint globally for oil trade. A little over 20m b/d of oil flows through the Strait, with exports from key producers Saudi Arabia, Iraq, Iran, the UAE, Kuwait and Qatar.

We believe the likelihood of a blockade is low, given firstly, it would be difficult to impose, secondly, it would not be in Iran’s own interest, and finally, it would likely see a strong global response. However, it is still worth exploring the impact.

The potential impact would dwarf the disruptions we have seen in the Red Sea in recent months, given the volume of oil that flows through the Strait and also due to the fact that there is no alternative route for the bulk of these oil exports. As we mentioned in a note earlier in the year, Saudi Arabia does have 5m b/d of pipeline capacity, which would allow crude to be carried to the Red Sea and exported from there, while the UAE has a pipeline with capacity of 1.5m/b/d which would allow for the export of oil from the Gulf of Oman, so avoiding the Strait. This still leaves approximately 14m b/d of oil supply at risk in the event of a blockade.

This would lead to a significant price shock where we could see Brent break above US$200/bbl by the end of the year, given the significant drawdown we would see in global stocks. Prices would need to remain elevated to ensure significant and rapid demand destruction, and any supply response from other producers would take time.

How could supply losses be dealt with?

The ability of the market to respond to any potential supply disruption would depend on the severity of any supply cuts. Given that OPEC is sitting on more than 5m b/d of spare production capacity, this means that the market should be well-placed to respond to most supply hits. This will largely depend on the willingness of OPEC to increase supply. The group will likely become increasingly concerned about potential demand destruction if prices move too high, sustainably above $100/bbl.

OPEC spare capacity would be able to help the global market in the case of stricter sanctions against Iran or any significant supply disruption from Iran. Where this spare production capacity does not help, is if there was a blockade of the Strait of Hormuz – the bulk of spare capacity sits within the Persian Gulf. Saudi Arabia, the UAE, Iraq and Kuwait hold 95% of total OPEC spare capacity.

Any significant supply shocks would also likely lead to a coordinated global release of stocks from emergency reserves. While the US has drawn down significantly on its strategic petroleum reserve (SPR) since Russia’s invasion of Ukraine, the SPR still stands at more than 360m barrels, leaving it with the option to tap into this.

Significantly higher prices would also ensure there is a clear incentive for producers elsewhere to increase drilling activity. While US producers would be the quickest to respond, it would still take several months for increased drilling activity to feed through to higher oil supply.

The key takeaway is that the oil market from a supply perspective should be able to cope relatively well with any disruptions/losses to Iranian supply. Where it becomes increasingly more difficult for the market is if Persian Gulf supplies are lost due to a blockade of the Strait of Hormuz.

OPEC has plenty of spare capacity, but 95% of it sits in the Persian Gulf (m b/d)

IEA, ING Research

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post