gopixa

Finding income in the current market is more difficult. With prices still high even though the rate of inflation has come down and many leveraged funds focused on income struggling with rates up, dividend and income investors are having a harder time in the economic environment.

An increasingly common investment that is focused on dividends and income is covered call funds. One options fund using this strategy that has been successful is the Neos S&P 500 High Income ETF (BATS:SPYI).

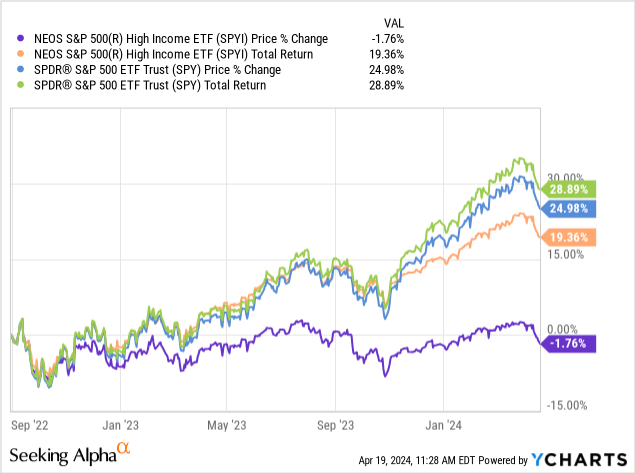

SPYI has offered investors a total return of 19.36% over the last 3 years, while the S&P 500 (SPY) has offered investors a total return of 28.89% during this same time period.

I last wrote about SPYI in August of last year. I rated the fund a buy, primarily because of the ETF’s options strategy and the market environment. I am upgrading this fund to a strong buy today. SPYI’s options strategy should enable this exchange-traded fund to outperform in what should be a more volatile year with growth expectations low, tensions abroad, and political uncertainty in the US. The fund should also be able to offer consistent and solid income without significant NAV erosion because of the call spread strategy the fund uses.

SPYI has an expense ratio of .68%, the fund has $1.13 billion in assets under management, and a trailing yield of 12.10%.

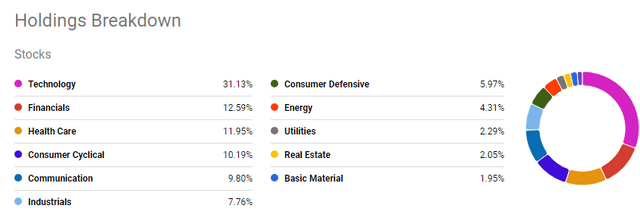

The fund tries to track the S&P 500, and currently holds 31.13% technology, 12.59% financials, 11.95% health care, 10.19% consumer cyclical, 9.8% communication, 7.76 industrials, 5.97% consumer defensive, 4.31% energy, 2.29% utilities, 2.05% real estate, and 1.95% basic materials. The largest holdings of the fund are Microsoft (MSFT), NVIDIA (NVDA), Amazon (AMZN), and Apple (AAPL).

A list of SPYI’s Holdings (Seeking Alpha)

The options strategy is focused buying and selling monthly index options against the equity holdings of the fund. The ETF used to sell call spreads against the core holdings of the fund, but the managers of this exchanged-traded fund changed to primarily selling covered calls late last year. SPYI sells options nearly 5% out-of-the-money, so the investor in this fund retains some upside in the assets held by this fund.

SPYI’s options strategy limits upside potential but leaves the ETF with unlimited downside risk. The fund buys and sells index options against the ETF’s equity holdings, and the exchange-traded fund tries to track the S&P 500 with the underlying holdings. SPYI’s options strategy previously used straddles and call spreads using that qualify as 1256 contracts, which means that 60% of the income from these transactions is taxed at long-term rates. Today, the fund is primarily selling covered calls, so SPYI’s monthly payouts will likely continue to be taxed at ordinary income rates.

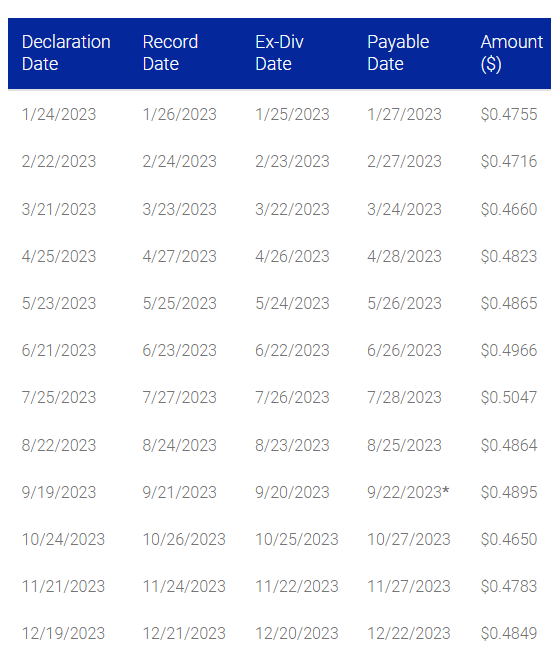

SPYI has consistently paid out regular income, with payouts normally ranging from $.46 a month to $.50 a month.

A list of SPYI’s payouts (neosfunds.com)

SPYI has outperformed XYLD over the last three years by nearly 10 percent, but the fund has underperformed JEPI (JEPI) by nearly 4%, as measured by total returns. JEPI also sells monthly out-of-the-money calls, but the JP Morgan fund invests some of the proceeds in the underlying assets of the fund that based that seek to track the S&P 500. XYLD sells at-the-money options, so this fund offers minimal to no upside in the underlying holdings of the ETF.

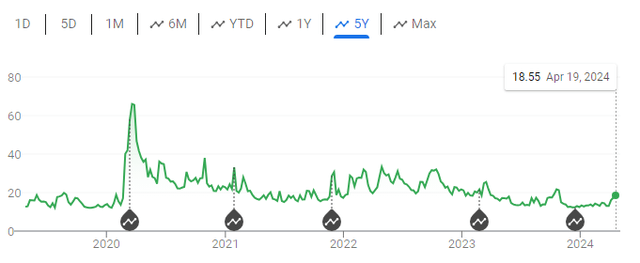

The strategy of selling covered calls works best in a range-bound market when volatility is at an elevated level, since in this kind of market environment the value of the premium in the options being sold is higher than normal but risk to principal remains minimal. This options strategy should work well in the current market that is dealing with political uncertainty and economic uncertainty, as well as heightened tensions globally.

A chart of the VIX (CBOE)

The VIX remains near a five-year low, volatility levels are likely to rise throughout the year. Economists are still predicting 2024 to be a slow growth time, and tensions sadly continue to flare up in the Middle East. The Fed also likely won’t want to be seen as interfering in the election, and prices remain high even though the rate of inflation has moderated to nearly 3%.

Investing strategies have to evolve as market conditions change even when long-term objectives remain the same. With prices high and markets likely to remain range-bound for some time, covered call funds such as SPYI should offer solid income. While covered call funds don’t limit downside risks, economic growth is predicted to remain stable in 2024.