champpixs

Almost a year ago, I penned a draft for Upstart (NASDAQ:UPST) titled: Upstart: Too hard basket until interest rates turn. I had expected the nearing quarterly report to be negative, but instead it was very positive, and instead I completely rewrote the article as “A leaner Upstart can grow from here” and rated the stock a buy.

In the 11 months since, the stock is up 33% compared to the S&P500’s 22%, a nice outperformance but the investor has had to stomach a quadrupling before a gut-wrenching ~70% draw down. Such was the volatility, the roller coaster image I used could not have been more perfect. An investment in Upstart is not for the faint of heart.

My article today returns to my original thinking, that Upstart remains a hold until the rates cycle turns, at which point it will be an aggressive buy. The business is still leaner than it was before the start of the rate hiking cycle, but sales have continued to decline due to the tough personal lending environment, and even though Upstart has improved their relationships with investors with regards to packaging loans, their balance sheet is still full of them.

Trends Improving

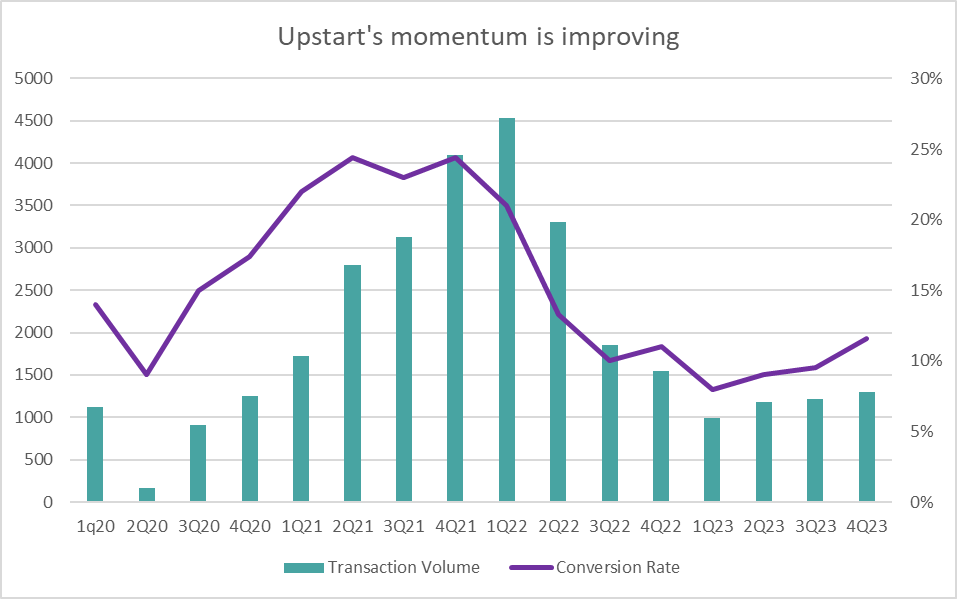

Post pandemic, Upstart rocketed on soaring transaction volumes, strong conversion rates, and impressive repayment metrics that all seemed to validate their value proposition of a more accurate way to estimate the creditworthiness of a borrower using artificial intelligence and big data. When money was cheap and stimulus checks were being handed out like candy, bad debts across the board were low. But as the Fed tightened things, repayments fell and defaults rose.

Equally important for Upstart and their partners, the higher interest rates made it more difficult for new loans to be approved, as serviceability on the same income would be more difficult. This is what led to Upstart’s conversion rate falling from a peak of 24% in late 2021 to 8% at the start of 2023.

All that background was to lead into this: that trend is starting to change. Both the conversion rate and the transaction volume have improved sequentially each quarter this year and revenue has followed. Even net income, which was still a loss of $42m in 4Q23, is an improvement on the loss of $129m in 2Q23.

Company filings

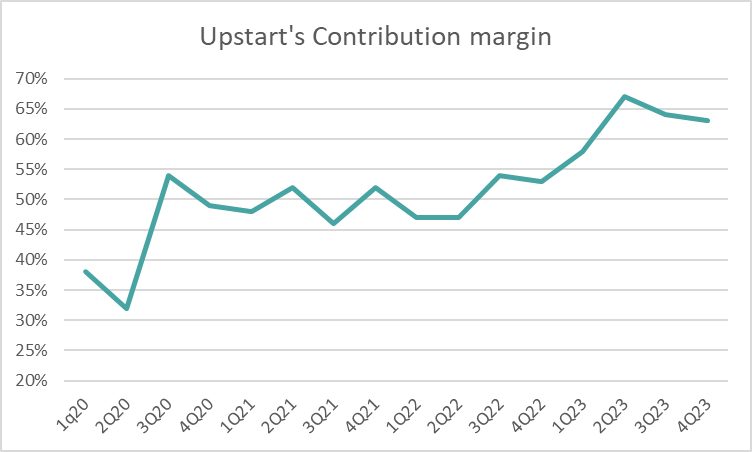

There has also been a marked improvement in the contribution margin. Not just over the last year, but since listing. There is actually no discernible correlation of contribution margin and transaction volume/conversion rate through the heady heights of the 2021 bubble (and yes, I think we can all agree it was a bubble) to the lows of early 2023 as described above. But most importantly, it has continued to improve.

Company Filings

Contribution profit is actually a very important indicator of loan efficiency, as it subtracts customer acquisition costs (CAC) and verification costs from fee revenue. By ignoring overheads and by just focusing on the cost of originating loans we get something that looks a little like gross profit, and as a percentage of revenue (aka contribution margin) this has been improving significantly. This means Upstart is getting better at landing new customers and means there should be more revenue left over as you progress down the income statement.

Balance Sheet Woes

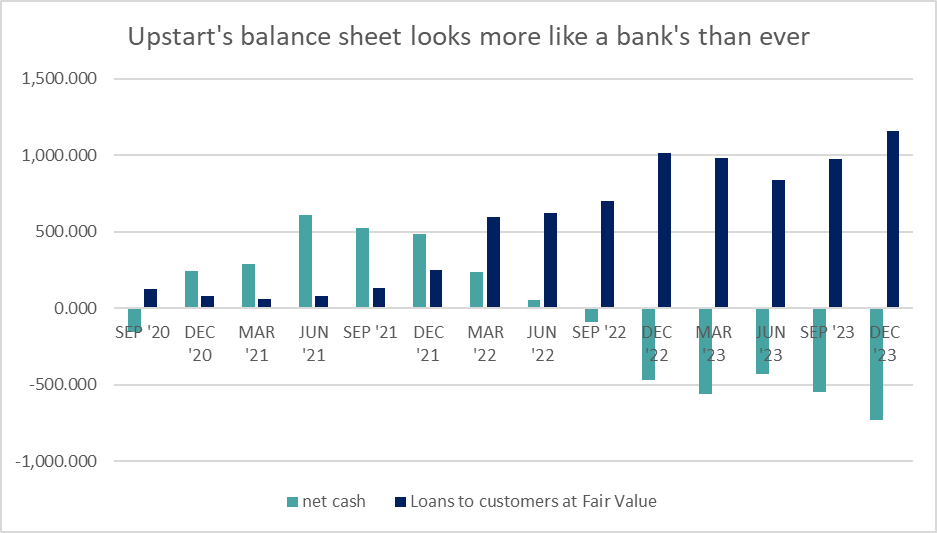

However, it is not all positive news. Since the Sep 2021 quarter, cash has dwindled and debt has ballooned. Since 3Q21, net cash has gone from $609m to net debt of $729m in Dec 2023. So despite the improvements at the operating line, the business is situated far more precariously now than ever before.

As I noted in my initial article, the reason for this shift is that the institutional market, into which Upstart packages and sells the loans it originates via its platform, dried up. Upstart took on bank debt in order to put these loans as assets on their own balance sheet. In theory, there isn’t really a problem with this business model. Indeed, that is the business model of most banks. But Upstart doesn’t want to be a bank, nor does its investors. But that is the situation it found itself in. Management is on the record saying they still want these to be unwound but considering the direction interest rates have taken in the past 2 years, this would require taking a significant haircut on the loans if they were now sold.

Company Filings

In my initial article on UPST, I also noted:

Investors who follow Upstart will know that the March 2022 quarter saw a huge inflow of loans onto Upstart’s balance sheet. Investors were wary because Upstart is supposed to be an enabler not a bank, and indeed, to my relief, the company continues to reassure investors that they have no intention of becoming a bank.

Despite these reassurances, there have actually been no signs that the loans on the balance sheet are declining (see above chart). This is potentially because the higher interest rates means that the loans that Upstart has are likely underwater and to dispose of them would crystallize a loss. To be sure, this loss is already seen on the income statement at the line “Fair Value and Other Adjustments,” but as the loans mature and are paid out by customers, any negative adjustments would be reversed.

Jay Powell, the Catalyst

So, why do I say that a change in the direction of rates is the time to buy? Because this will alleviate much economic stress. It will reverse the negative dynamics that have plagued Upstart. Borrowing rates will come down so not only will defaults decline but transaction approvals (and hence volumes) will also improve. This all adds to Upstart’s top and bottom lines.

Just as important, I think this will signal a major sentiment shift for stocks that will benefit from falling rates, leading to a sharp repricing of the stock.

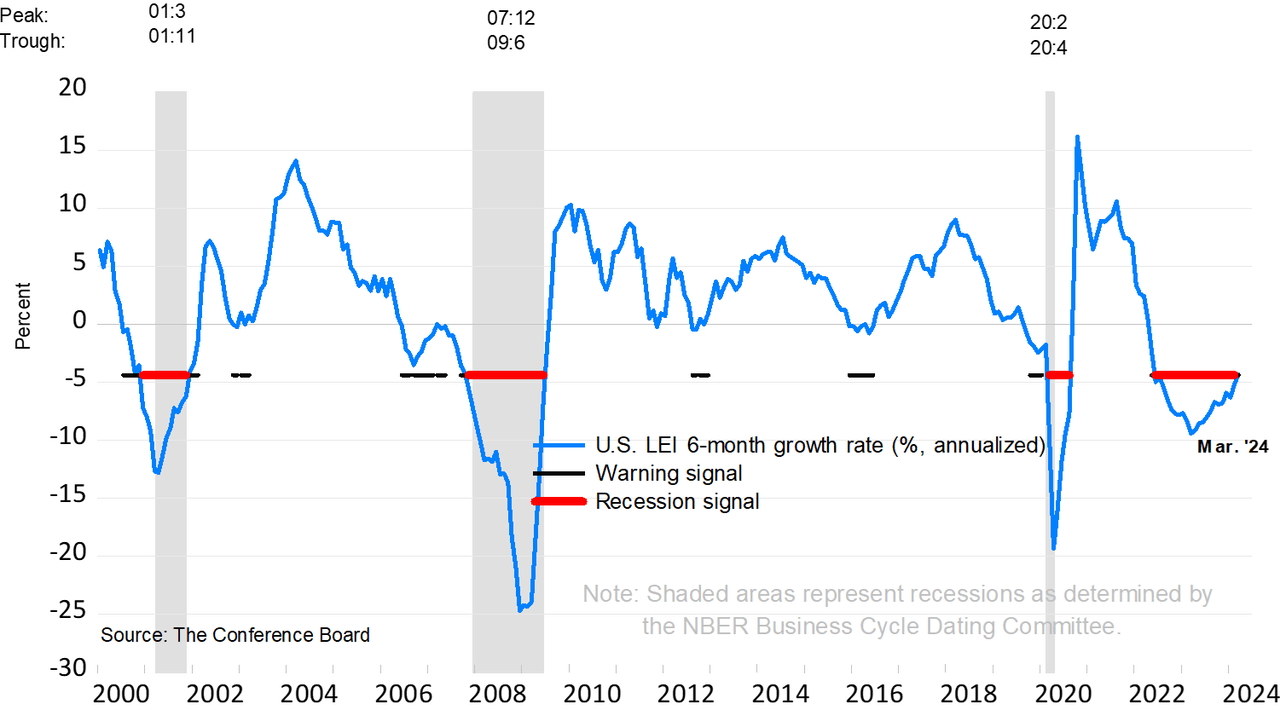

Further, because Upstart deals in lending, economic strength is important, and particularly for Upstart – because it deals primarily in personal loans – a strong consumer. The US Conference Board, the arbiter of the US business cycle and recessions, produces a “Leading Indicators Index”, which looks at various forward-looking economic indicators to gauge where in the business cycle we might be. Although the index had been suggesting a recession was likely for about 2 years, none has since materialized and recently the index has turned to suggest that the economy was, in fact, strengthening.

US Conference Board

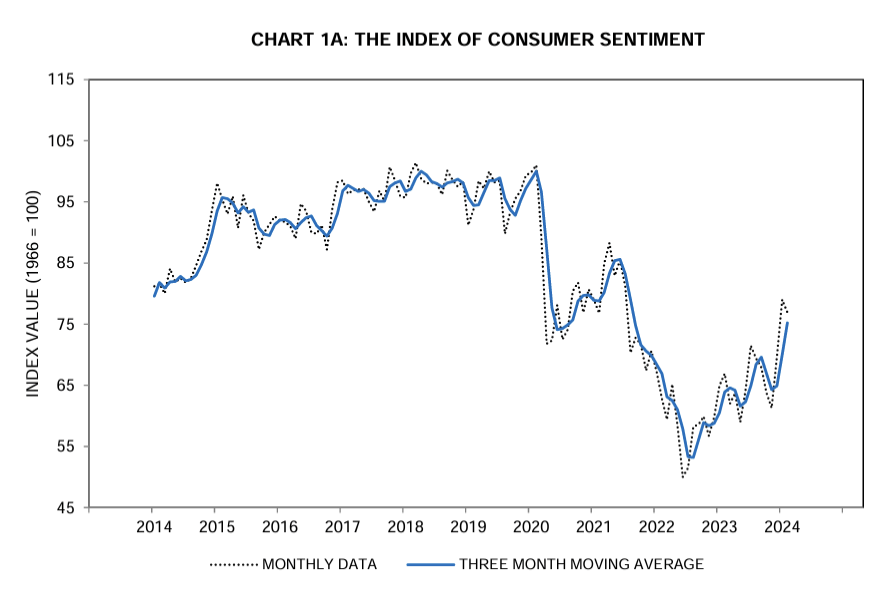

This gives some credence to the soft landing narrative. If a soft landing is achieved, wherein the Fed successfully reduces inflation via interest rate rises without incurring a prolonged economic downturn (otherwise known as a recession), this will be very positive for stocks exposed to the consumer such as Upstart. Further, below is a chart of the University of Michigan Consumer Sentiment Index. You will note on the chart that sentiment bottomed in about the 2nd or 3rd quarter of 2022. This was not long before Upstart’s conversion rate began improving.

University of Michigan

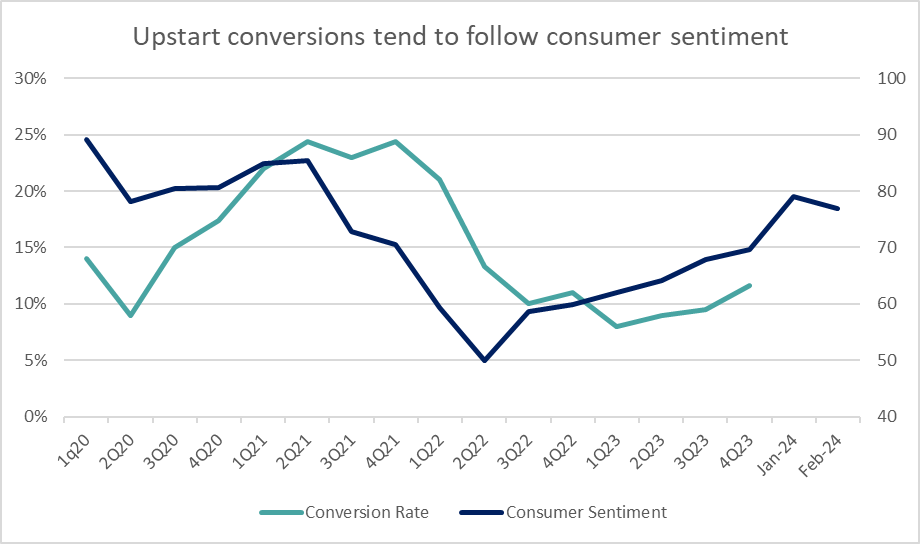

Presented differently, I have overlaid the last few years of Consumer Sentiment data with Upstart’s Conversion rate. Admittedly, the sample size is reasonably small, but I think it does show a trend that conversion rate follows sentiment with 6-12 months of delay. This is logical because if the consumer is upbeat, it likely reflects a good financial position as well as a strong (or strengthening) economy.

Consumer sentiment has been improving since mid-2022 and conversion rate since 1Q23. There was also a marked increase in sentiment in the first two months of 2024 (data is updated to February 2024), which I think could mean Upstart is in for another strong quarter when it releases its 1Q24 earnings on May 7.

University of Michigan, Upstart Filings

How this thesis could fall apart

CFO Sanjay Datta said on the 4Q23 conference call that per capita disposable income has been declining since before last summer while personal consumption has increased. Specifically, he said:

These contrasting portions of consumption and income over the back half of last year have left personal fiscal health and as precarious a state as they’ve been since the Great Financial Crisis with personal savings rates hovering close to all-time lows.

Datta continued to paint a pretty bleak picture of the consumer, citing rising default rates among “lesser prime, lower FICO borrowers,” with higher creditworthy borrowers starting to follow. Further, delinquency rates on car loans and credit cards (similar products to the loans Upstart sources) are the highest since the GFC.

This all stands in contrast to the picture I have painted above. What this means for Upstart is that they have tightened their underwriting standards, which could impact conversion rates negatively.

Conclusion

This is the bear case, that household balance sheets are weak with overspending and low disposable incomes leading to potential loan defaults and a poor Upstart loan conversion rate.

The bull case is that if rates begin falling, that won’t matter because this will help disposable income and reduce the strain on personal budgets. A stronger consumer and a stronger economy will mean more loans are likely to be approved by Upstart and there will be healthy appetite for the loans in the funding environment, respectively.

I will leave it to the reader to decide for themselves which case is stronger. With the timing of rate cuts remaining uncertain and higher delinquencies in the consumer market that Upstart primarily deals in, I find it difficult to recommend Upstart as a buy. But the fact that the direction of the next rate cut is likely to be down plus the improvement in efficiency the company has generated (as seen by the steadily improving contribution margin) remains positive for the medium term outlook. As a result, I see UPST as a hold. I’m not ready to buy yet, but I can see the day approaching.