you

Enterprise Products Q1 Review

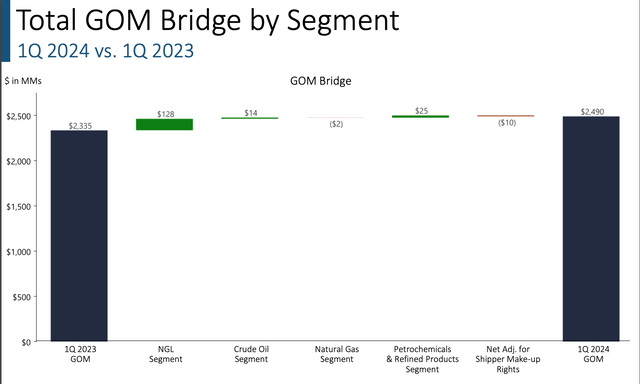

Enterprise Products (NYSE:EPD) reported another typical quarter this week. The company delivered $2.5 billion of adjusted EBITDA for the quarter. That made for $9.5 billion over the past 12 months and a leverage ratio of 3x. The company expects to bounce around that leverage ratio plus or minus 25 basis points.

The company increased the distribution to $0.515, a 5.1% increase from last year. That is commensurate with the increase in the company’s DCF (distributable cash flow).

I recommend anyone interested in EPD stock to review Enterprise’s quarterly earnings presentation. It tells you most of the salient operating results for the company. I’ll go through the important slides here.

At its heart, EPD is a fee-based business where NGLs (natural gas liquids) make up over half of the operating margin. Therefore, it’s no surprise that the bulk of any growth in operating margin company-wide will come from the NGL segment

EPD Company Gross Operating Margin Bridge (EPD Q1 Presentation)

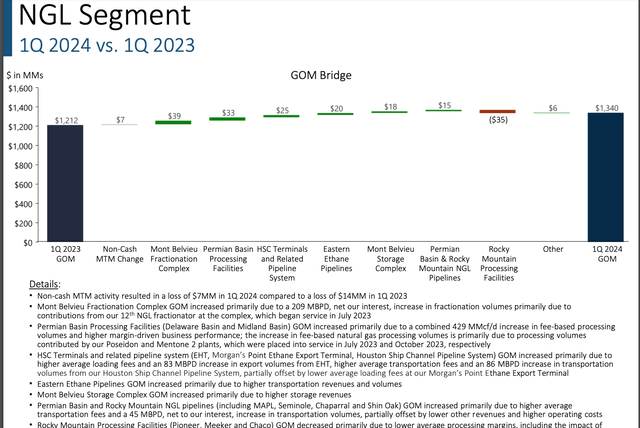

The good news is that the NGL segment is growing basically across the board.

NGL Segment Gross Operating Margin Y/Y Bridge (EPD Q1 Presentation)

The stability and stable growth of these numbers are what provide the funds that allow this company to pay a run rate $2.06/unit distribution while still funding ~$3.5 billion of growth capital and maintaining a bulletproof balance sheet. Unlike many companies facing maturity walls of low cost capital coming off, EPD has a 19-year weighted average life of debt at a weighted average cost of 4.7%.

Growth of Export Capacity

I don’t think many investors appreciate how important the US has become as an exporter in the global energy markets. According to the IEA, the US exported 3.62 million barrels of energy liquids in 2013, comprised of crude oil, refined products and natural gas liquids. Today that number is 12.1 million barrels.

EPD plays a big role in those exports, especially its NGL export infrastructure on the Gulf Coast, especially the Houston Ship Channel. The company exports 2.33 million barrels per day or around 70 million barrels per month of liquids. It was discussed on the quarterly conference call that the company has initiatives to grow to 100 million barrels per month.

Since the Houston Ship Channel is capacity constrained, one way for the company to hit that 100 million goal is development of SPOT (seaport oil terminal) 30 miles off the Brazoria County coast in Texas. SPOT just received a deepwater port license in April. It will be connected to EPD’s oil pipeline network and have a VLCC (very large crude carrier) docking ability that will allow for 2 million barrels of loading capacity per day.

The company is currently seeking contracts for SPOT before making the FID (final investment decision), a process it expects to complete by the end of this year. Once SPOT is completed and operational, most if not all of the company’s oil export capacity that occurs in the Houston Ship Channel can be moved to SPOT.

EPD Stock Valuation

At just over 9x EBITDA with a 12.2% free cash flow yield and a little over 7.25% distribution yield, EPD units are essentially high-yield bonds that grow 5% per year. It’s better than a bond from a tax perspective though, as the distributions are largely return of capital, which makes the payments highly attractive to individuals.

Conclusion

I love EPD’s assets and have enormous respect for management. The units have had a nice run for the past few quarters, but they are still below their pre-Covid high despite tremendous growth of the assets, the cash flows, and reduction in leverage. This company is a core part of my portfolio and I expect to be so for years.