MichaelJay/iStock via Getty Images

We changed our outlook on our last coverage of Crescent Point Energy Corp. (NYSE:CPG, TSX:CPG:CA). While we had endorsed the bull case in 2022 and earlier in 2023 (twice), we downgraded this one to a “Hold” in November 2023.

Free cash flow yields are going to drop like a stone here and if we see $65 oil in a recession, CPG will really regret this transaction. The very weak Canadian dollar is partially offset here for the company (as oil in Canadian dollars has stayed really firm). So we cannot get too negative, despite this dubious move. We’re moving to a Hold rating and are still weighing the best roll for the existing calls.

Source: Running After That Untamed Ornithoid.

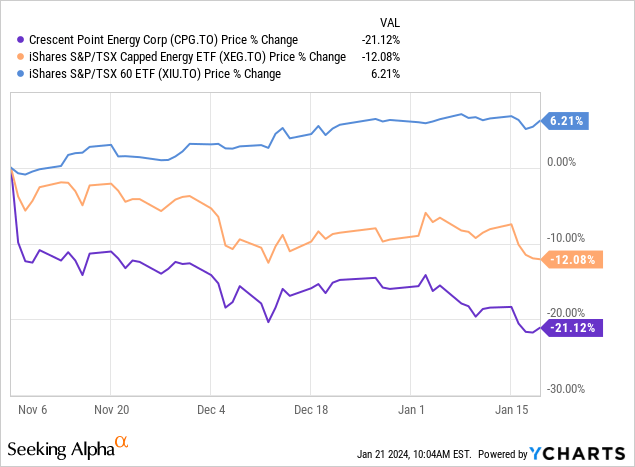

The call has worked out, and the stock has dropped a lot since then, lagging the broader market represented by iShares S&P/TSX 60 Index ETF (XIU:CA) and also the Canadian energy ETF, iShares S&P/TSX Capped Energy Index ETF (HEG: CA).

We tell how we positioned defensively on our calls and look at how CPG has blown away all near-term upside. We also go over what it would take to upgrade this to a buy once again.

Outlook

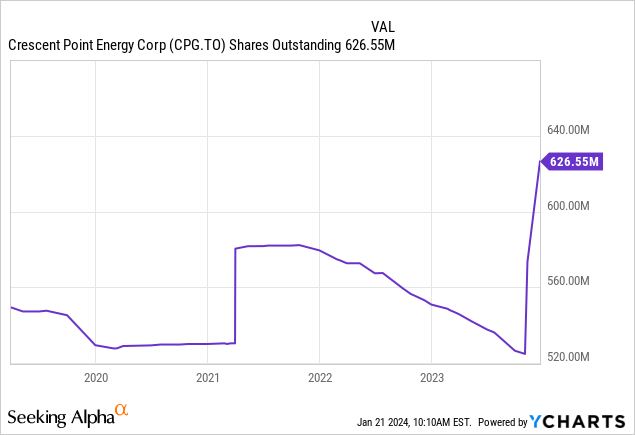

CPG came into 2023 with one of the best setups you could find. A deleveraged balance sheet and the opportunity for increasing capital returns. Sure, you had a relative lack of longer-term drilling opportunities. The proved and probable reserve life was perhaps a little less for management hoping to take this into their golden years. But that had a counterbalance. CPG was trading at a ridiculously low valuation. All management needed to do was to keep buying back shares and focus on reserves and production per share. For a while, they had us going. You can see that in the chart below between early 2021 and late 2023.

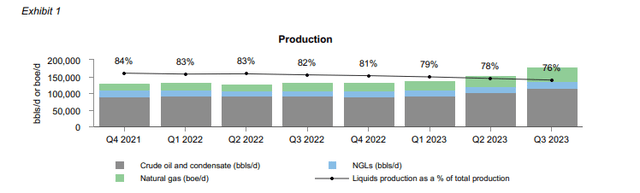

Of course, they ended that with “Haha, just kidding. We had you going there didn’t we?” The transactions went from poor to exceptionally bad. The last one for Hammerhead was such a negative one in our opinion, that the only way we don’t regret it is if oil prices average well over $90.00/barrel. Alongside that, CPG dialed down its liquid percentage. The gassy transactions had already weighed on the Q3-2023 numbers and liquids were down from 84% to 76%.

CPG Q3-2023 Presentation

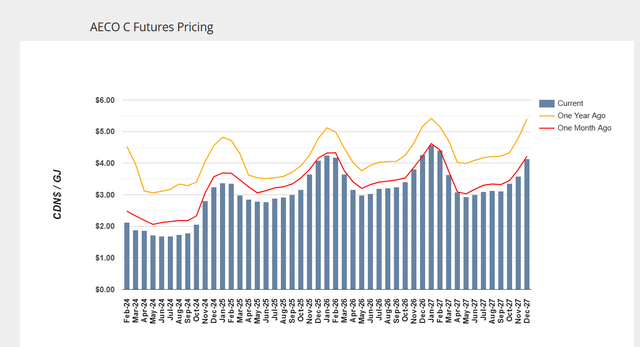

This does not even reflect the Hammerhead transaction which closed after Q3 2023. Gas will be 35% of the total production in 2024. Just in time for an absolute obliteration of the AECO Gas strip.

AECO

What more could you ask from management to provide you with motivation to actually hit the sell button? The recently released five-year plan actually highlights that they have 20% more cash to give you.

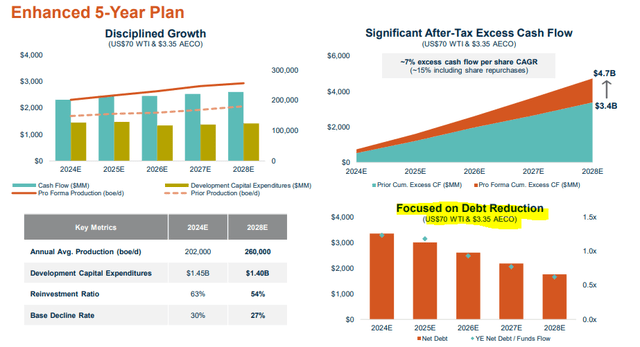

Crescent Point’s annual production is forecast to grow to approximately 260,000 boe/d in 2028 under its five-year plan, driven by the Company’s Alberta Montney and Kaybob Duvernay assets, with cumulative after-tax excess cash flow of approximately $4.7 billion at US$70/bbl WTI and $3.35/Mcf AECO. Under this five-year plan, the Company expects to generate excess cash flow per share growth of seven percent on a compounded annual basis, or 15 percent including the benefit from expected share repurchases. This enhanced profile highlights the strong contribution of the newly acquired Alberta Montney assets, which are expected to provide the Company with a combination of growing production and lower capital expenditure requirements to sustain production in later years. On a per share basis, Crescent Point’s cumulative excess cash flow under its five-year plan has increased by approximately 20 percent as a result of the Transaction.

Source: CPG.

Oh yeah, that was based on AECO’s $3.35/MCF, not the $1.85/MCF we see on the April 2024 contract. This comedy would not be complete if CPG did not throw in another, “we are focused on debt reduction” slide.

CPG Presentation

The news flash here is that CPG had finally gotten where it needed to be in 2023. All that was needed to be done was core execution and responsible buybacks. All of it was thrown out to buy one of the poorest free cash flow producing companies that one could find: Hammerhead. There are rumors that CPG might once again bid on Chevron Corporation’s (CVX) assets as the giant exits Canada. We have stocked up on Domperidone just for that possibility.

How We Played It

As the news hit, we closed out our calls for the $7.50 strike and shifted them down to $5.00. Our rationale was that the price we would be willing to just go along, without any call protection, was near the $5.00 mark. In the interim, we can collect the dividend and get a relatively high yield off our very low adjusted cost base.

Verdict

At this point, capital is not coming back to this management. Even the hardcore fans of this company have had enough. Don’t get us wrong, being longer-term bulls on the energy complex, makes it hard to rate things as a “Sell,” unless the valuation gets outlandish. We have done that for Texas Pacific Land Corporation (TPL) at times, as it traded at 22-30X EV to EBITDA. That is clearly not the case here. At near 3.0X EV to EBITDA, it is hard to push a sell rating unless someone expects sub $60 oil permanently. But what we mean is that there is room for CPG is to become the downright last company anyone will invest in for energy exposure in Canada. You could see this trade at the lowest valuations of the peer group, even if we have a multi-bull market.

Avoid Crescent Point Energy Corp. and focus on better quality choices in the upstream space. Whitecap Resources Inc. (WCP:CA) is one we like and even some gassy plays like Peyto Exploration & Development Corp. (PEY:CA) are better priced for upside here.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.