MarsBars

It’s easy to say that emotions should be taken out of investing, but that’s hard to implement in real life. That’s because investing is not just pure science for most people, since along with each stock purchase or sale comes with it the hopes and dreams of a better financial life ahead.

Perhaps that’s why people will sometimes overthink their investments, which can result in too much trading activity, and that can be detrimental to one’s portfolio returns. A better approach may be to not overthink it, and simply buy solid income producers when they become attractively valued, as is the case with a number of net lease REITs in today’s market, including Alpine Income Property Trust (NYSE:PINE).

I last covered PINE in June of last year with a ‘Buy’ rating, noting its attractive 7% yield, well-positioned portfolio, and undervaluation compared to peers. The stock is down by 3.6% since then, and it appears that the recent market exuberance has worn off since the stock price hit $17+ in December, as shown below. In this article, I revisit PINE and discuss why it remains a good stock candidate for high yield, so let’s get started!

PINE Stock (Seeking Alpha)

Why PINE?

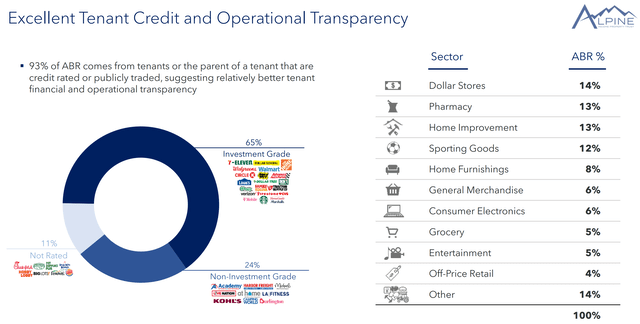

Alpine Income Property Trust is an net lease REIT that’s externally-managed by another publicly-traded REIT, CTO Realty Growth (CTO). Unlike other net lease REITs that may be diversified across industries like retail and industrial, PINE is focused exclusively on retail properties. As shown below, the majority of its tenant segments are e-commerce resistant with dollar stores, pharmacy, and home improvement being the top 3 sectors, comprising 40% of ABR (annual base rent).

Investor Presentation

At present, PINE’s carries a portfolio of 138 properties across 35 states, and derives 65% of its ABR from investment grade-rated tenants with strong real estate fundamentals. This is supported by the fact that 42% of PINE’s ABR stemming from the top 10 metropolitan statistical areas in the U.S. with total portfolio weighted 5-mile average household income of $100,200 sitting well above the $75K national average, and an average 5-mile population of 114K.

PINE has continued to seek opportunistic growth, as reflected by 14 net lease properties acquired last year for $83 million at a 7.4% cash cap rate and three first mortgage originations totaling $39 million at a 9.1% initial yield. While PINE’s low share price over much of the past 12 months made cost of equity prohibitively high, it was able to fund investments through portfolio recycling. This includes the disposition of 24 properties for $108 million last year at a weighted average exit cap rate of 6.3%, generating gains of $9.3 million, and enabling PINE to realize a positive average 159 basis points spread between disposition and acquisition cap rates.

Notably, PINE did have to deal with the Valero branded Mountain Express tenant credit loss last year, which impacted seven properties. While this represents a near-term headwind considering that PINE only has 138 properties total, management has made progress on re-leasing some of those properties, as noted during the Q&A session of the recent earnings call:

Q: what is the latest in terms of the Mountain Express stuff? Is that going to wind up being some of the sales this year? Is that all going to be re- tenanted some of it? How are you guys looking at that at this point?

A: Yes. So we’re in active discussions with a number of operators. We’ve got two leases signed on two of the locations. We’re working on three more, and then we’re in preliminary discussions on the other two. We’re still anticipating selling them just given our focus on publicly traded, or publicly rated tenants, but we’re in active discussions to have all of that leased in the near to medium term.

Looking ahead, I believe PINE limited in its capacity to materially grow the portfolio in the near term, as management has stated that they are going to be focused on upgrading portfolio quality, as in the case with the Mountain Express properties, through asset recycling.

Nonetheless, PINE has demonstrated that it’s shareholder friendly, by repurchasing shares at the current discounted valuation. This is reflected by $9.5 million spent on share buybacks during Q4 at a weighted average price of just over $16 per share at an implied cap rate of 8%. Considering PINE’s discounted price of $15.97 with forward P/FFO of just 10.3, I view share repurchases as a continued avenue to return value to shareholders.

This is supported by retained capital after paying the divided, with an FFO payout ratio of 74%, and investors currently get an appealing dividend yield of 6.9% in the meantime.

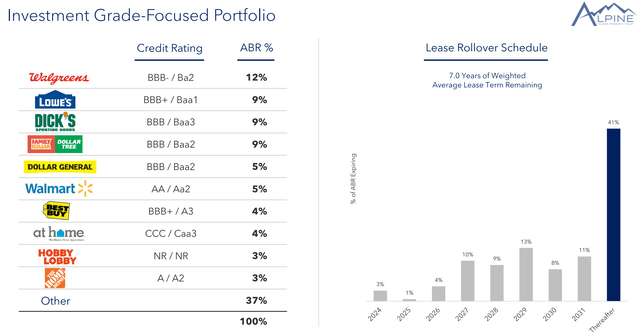

Risks to PINE include its smaller size, which makes tenant issues such as the one with Mountain Express last year stand out. PINE also has outsized portfolio concentration in tenants like Walgreens (WBA), Lowe’s (LOW) and DICK’S Sporting Goods (DKS), and that’s something to be mindful off, although it would be unlikely for its tenants to exit all of its properties all at once considering their investment grade balance sheets. As shown below, PINE has limited lease maturities through the end of 2026 with no more than 4% of leases each year between now and then.

Investor Presentation

Moreover, PINE doesn’t carry the same level of balance sheet strength as industry peers like Realty Income. This is reflected by its net debt to EBITDA ratio of 7.7x and net debt to total enterprise value of 51%. However, I’m willing to give PINE a pass as it’s not uncommon for younger REITs like PINE, which IPO’d in 2021, to carry higher leverage at the outset. Over time, I’d like to see leverage trend below 7.0x and net debt to TEV tend toward 45%, and is something I’d watch for. As shown below, PINE has no debt maturities until 2026, thereby buffering the impact of higher interest rates in the near term.

Meanwhile, I believe investors are well compensated by the 6.9% dividend yield and low valuation at the current price of $15.97 with forward P/FFO of 10.3. Analysts expect 5% annual FFO/share growth over the next two years, which when combined with the dividend yield could produce above market returns.

I believe this growth rate is reasonable should there be no big surprises in tenant defaults and with rent escalators and share repurchases at the current accretive share price valuation. Plus, I believe PINE could reasonably trade at a P/FFO in the 11x to 13x range, giving the potential for share price appreciation in the near-term, especially if the Federal Reserve provides more clarity on the timing of rate cuts this year.

Investor Takeaway

Overall, Alpine Income Property offers an attractive opportunity for investors looking for high yield backed by a quality assets and potential for share price appreciation. With a strong portfolio of investment-grade tenants, and shareholder-friendly actions such as share buybacks, PINE is well-positioned to continue delivering value to its shareholders. While there are some risks related to tenant concentration and balance sheet strength, I believe PINE has the potential for above-market returns in the near future due primarily to its undervaluation and yield. As such, I maintain a ‘Buy’ rating on PINE.