AKKHARAT JARUSILAWONG/iStock via Getty Images

Legends are best left as legends and attempts to make them real are rarely successful”― Michael Moorcock

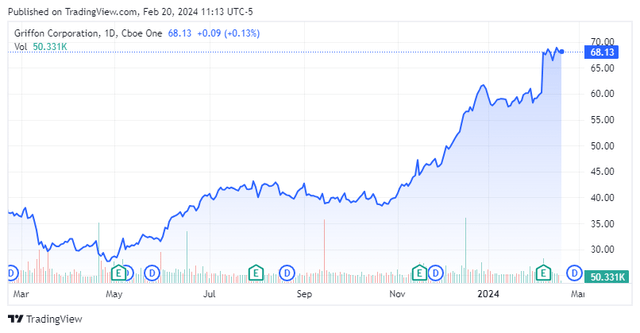

Today, we put building products supplier Griffon Corporation (NYSE: GFF) in the spotlight for the first time. Despite the weakest existing home sales of this century in 2023, the stocks of most home builders and building materials stocks have done quite well over the past 12 months even as 30-Year mortgage rates remain stubbornly around seven percent. The stock of Griffon Corporation is up over 80% over the past year. Can the good times continue for shareholders, or is the stock vulnerable to profit taking after its large rally at some point in 2024? An analysis around Griffon Corporation follows below.

Seeking Alpha

Company Overview:

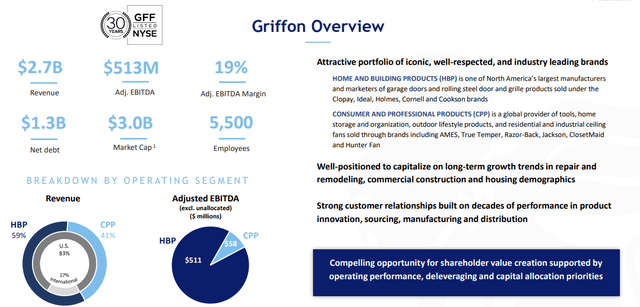

February Company Presentation

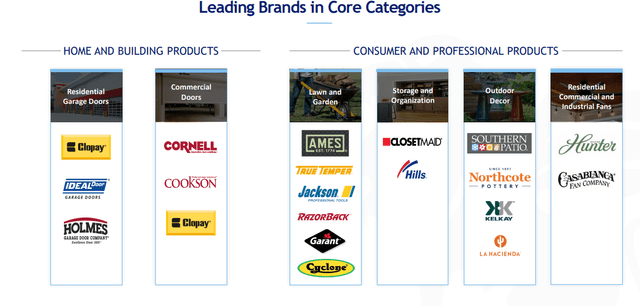

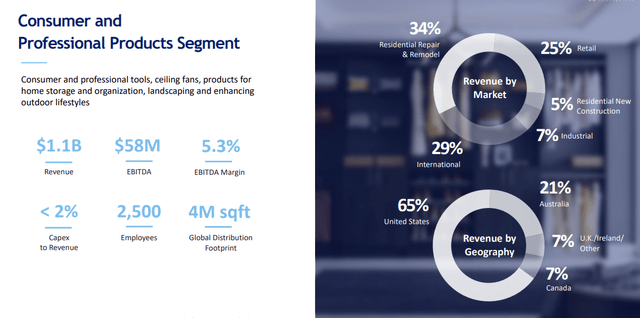

Griffon Corporation is headquartered in New York City and operates out of two primary business divisions: Home and Building Products, and Consumer and Professional Products. The former makes and supplies products such as garage doors, rolling steel service doors, fire doors, shutters and steel security grilles. These business segments contribute roughly 60% to overall sales. The latter provides products like spades, hoes, cultivators, weeders, post hole diggers, scrapers, edgers and forks as well as wheelbarrows and lawn carts. The stock currently trades just over $68.00 a share and sports an approximate market capitalization of nearly $3.5 billion. Griffon Corporation is a diversified holding company, conducting business through its wholly-owned subsidiaries. Griffon operates on a fiscal year that begins on October 1st. The stock pays a small dividend of just less than one percent annually.

February Company Presentation

First Quarter Results:

Griffon Corporation posted its 1Q2024 numbers on February 7th. The company delivered non-GAAP earnings of $1.07 a share, 33 cents a share better than estimates. Net income came in at $42.2 million, compared to $48.7 million in 1Q2023.

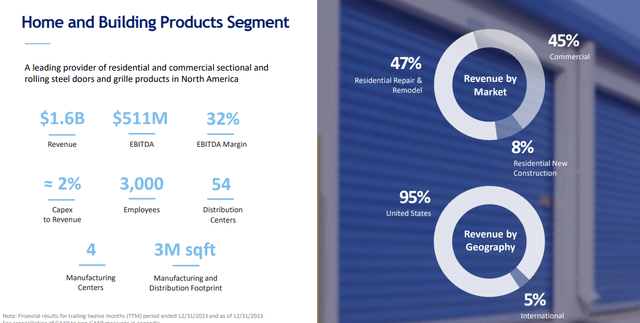

Revenues fell one percent on a year-over-year basis to $643.2 million, more than $45 million above the consensus. Home and Building Products revenues were flat compared to the same period a year ago at $395.8 million. Adjusted EBITDA came in at $124.7 million for the quarter. Revenues from its Consumer and Professional Products division was down two percent to $247.5 and produced an adjusted EBITDA of just $5.5 million.

FY2023 Results (February Company Presentation)

This continues a longer-term trend of the company getting much better performance from its Home and Building Products segment than its Consumer counterpart.

FY2023 Results (February Company Presentation)

Analyst Commentary & Balance Sheet:

Since quarterly results were posted earlier this month, Robert W. Baird maintained its Buy rating while upping its price target on GFF seven bucks a share to $82. Deutsche Bank also reiterated its Buy rating with a $88 a share price target.

Four company directors have sold approximately $1 million worth of shares collectively so far in 2024. This is first insider activity in this equity since 2021, it should be noted. Management also just announced it would repurchase 1.5 million shares from a beneficial owner of the stock that wants to lighten their stake in the firm.

February Company Presentation

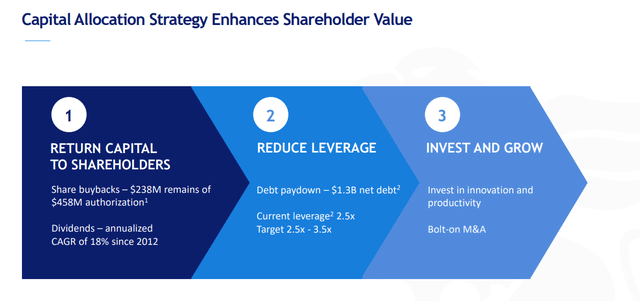

Griffon exited the first quarter of its 2024 fiscal year with $1.3 billion in net debt on its balance sheet and 2.5x leverage ratio. The company delivered an impressive $133 million in free cash flow during the first quarter of the new fiscal year and still has nearly $240 million available on an existing stock buyback authorization. Management bought back $70 million worth of equity in the first quarter.

Verdict:

Griffon Corporation (GFF) made $4.54 a share (non-GAAP) of profits in FY2023. The current analyst firm consensus has the company posting flat earnings in FY2023 as sales drop to $2.62 billion in sales. They see profits rising sharply in FY2025 to $5.55 a share on three percent sales growth.

The stock trades at roughly 15 times earnings and 1.3 times sales. Given flat earnings growth projected for this fiscal year on a slight decline in sales, that seems fairly priced given the uncertainty both in the housing sector and the overall economy. The shares are up some 70% since late October, when the recent rally in the overall market started. The equity seems vulnerable to profit taking and I am not surprised shareholders have taken some chips off the table in recent weeks. I would do the same and I would also remain on the sidelines in regard to the stock at these trading levels.

Storytellers seldom let facts get in the way of perpetuating a legend, although a few facts add seasoning and make the legend more believable.”― John Alexander