Shutter2U

Investment Thesis

On February 27, 2024, MPZZF released its Q4 figures. It reported Q4 revenues of $153 million and EBITDA of $94 million. The market did not like these numbers, and its 2024 guidance sent the share price down almost 11 percent from its close on February 26. This article updates my previous article on (MPZZF), written on November 28, 2023. In that article, I argued that its recent price drop provided an attractive pricing point for investors but warned that 2024 and onwards were likely to bring lower yields.

MPZZFs operational and financial track record is excellent; it sports a fleet of more than 60 intra-regional container ships (<8k TEU size ships), has approximately 1.4 years of contract backlog, and low leverage with no significant maturities until 2027. However, concerns about global fleet growth and an uncertain market outlook provide headwinds. Additionally, the inherent risks of trading in a relatively small stock listed in a relatively illiquid currency may pose an issue for many investors. Consequently, MPZZFs receive a hold rating.

Company Overview

MPC Container Ships (OTCPK:MPZZF) is an intra-regional container ship lessor focusing on the 1k-8k TEU segments. Listed on the Oslo Stock Exchange since 2017, it controls 62 vessels with a total carrying capacity of 138,000 TEU.

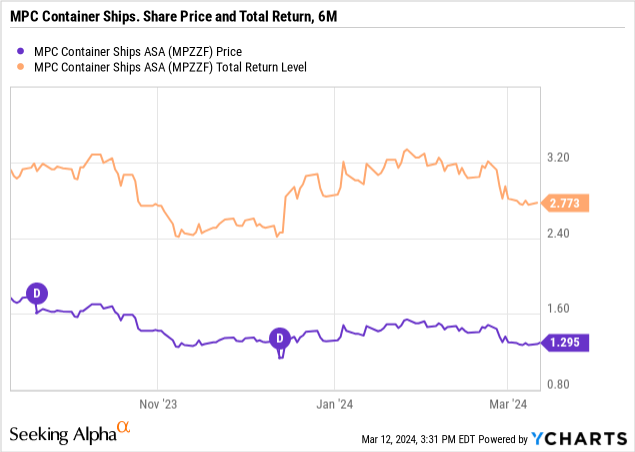

Let’s examine its share price development over the past six months. Both share price and total return have moved sideways since then. Note that MPZZF is listed in NOK, and the chart below is converted to USD:

Contract Backlog: More Contracted Days, Lower Rates

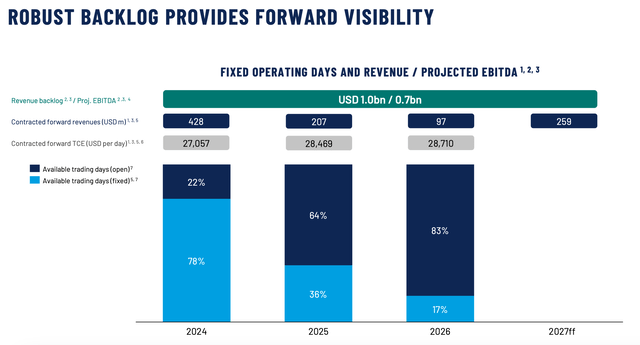

In its latest quarterly report, MPZZF provided the following contract backlog overview.

Contract Backlog as Q4, 2023 (Q4 presentation, p. 18)

Comparing this with its previous report (Q3 2023, p.16), we note the following (previous report in parenthesis):

⬆️ 78% (67%) of days contracted for 2024, at a forward TCE of ⬇️ 27,057 (29,410) ⬆️ 36% (25%) of days contracted for 2025, at a forward TCE of ⬇️ 28,489 (35,098)

In other words, MPZZF could contract more days but at lower rates. Contracted forward TCE for 2024 declined by 8 percent and 19 percent for 2025.

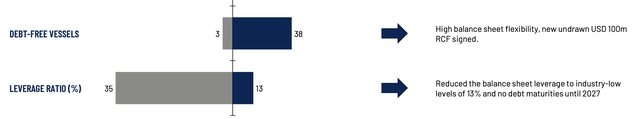

Leverage: Industry-Leading, With no Maturities until 2027

MPZZF’s leverage is just 13 percent, down from 35 percent in Q4 2021 (illustration from Q4 presentation, p. 16):

MPZZF Leverage Development, 2Y (Q4 2023 presentation, p. 16)

Additionally, it had 38 debt-free vessels compared to just three two years earlier.

Market Outlook

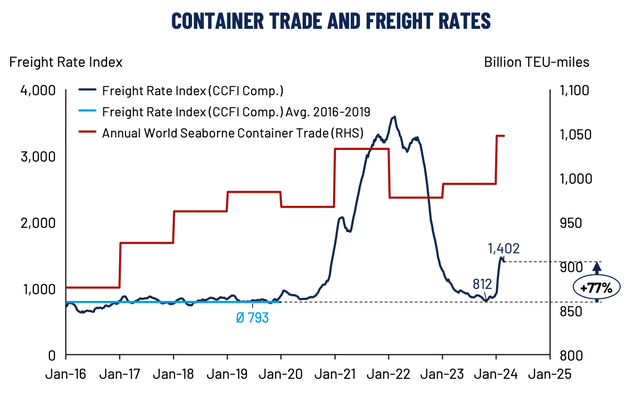

MPZZF provided the following illustration of charter rate developments (Q4 2023 presentation, p. 11):

Rates, Jan 16-Jan 24 (Q4 2023 presentation, p. 11)

It noted that while the usual Chinese New Year uptick was observed, it was “huge” this year due to the Red Sea disturbances. But – MPZZF does not observe any uptick in long-term contract rates, citing slow negotiations.

In comparison, its peer Danaos Corporation (DAC) reported closing deals at “healthy levels” in a news bulletin. It stated that

(..) it is expected that box rates will remain elevated as long as the [Red Sea] disruption continues. Against this backdrop, we have some secured additional charters for our vessels at very healthy levels.

BIMCO, the largest membership organization for shipping players, reported in its container outlook (Q4 2023, highlights) that

The supply/demand balance will continue to weaken and freight rates, time charter rates, and second-hand prices will come under further pressure.

It expects supply to grow 6.8% in 2024 and 6.4% in 2025, while demand is expected to grow just 3 to 4 percent in 2024 – and 3.5 to 4.5 percent in 2025.

Supply outpacing growth is not a good thing, of course. In the near term, this dynamic exerts downward pressure on container rates. In the medium to long term, I remain fundamentally optimistic about the feeder segment (<8k TEU) of the container market due to the world deglobalizing (the importance of regions increasing). Consider a country like China. In 2006, 64 percent of its economy was trade, compared to 37 percent in 2023. This opens up opportunities for other countries. This constitutes a move from relatively fewer giga ports (which favor mega ships) to several relatively more minor ports (which favor smaller vessels). In addition, maritime choke points like the Suez Canal (effects of war) and the Panama Canal (weather) are increasingly under pressure, supporting tonnage demand as sailing distances increase. Possibly, the South China Sea, too, as China continues to assert its territorial claims.

Risks Specific to this Investment

Withholding tax on dividends. U.S.-based investors should consider the effect withholding taxes may have on returns on their investments in Norwegian stocks. The Tax Administration has more.

The NOK. MPZZF trades in NOK, a small and relatively illiquid currency, compared to more significant and liquid currencies like the USD and the EUR. Foreign investors may see lower – or higher – returns based on fluctuations in this currency. In times of uncertainty, investors usually try to avoid riskier bets, which the NOK would represent. The Norwegian Central Bank’s primary goal is low and predictable domestic inflation – it does not attempt to peg the NOK to any other currency.

Conclusion

This article updates my previous article about MPZZF and reiterates its main selling points: its low leverage, excellent management record, delivery of its ambitious GHG goals, and young fleet. However, it is facing headwinds in a still-uncertain market. The Red Sea issues increase sailing distances, requiring higher tonnage supply, but the market outlook is still uncertain. Coupled with specific problems with the MPZZF stock, this investment is only for some.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.