There are five reasons stocks will rally after the Federal Reserve’s rate decision, Fundstrat’s Tom Lee says.

The S&P 500 is “soft” going into the FOMC meeting, which usually indicates a rally to follow.

Skepticism toward stocks and expectations for a hawkish Fed are reasons more gains may be coming.

Stocks are likely to rally after the Federal Reserve delivers its update on monetary policy on Wednesday, one of Wall Street’s biggest bulls says.

Fundstrat’s Tom Lee, a strategist who nailed his bullish call for 2023, says that there are five reasons he thinks there’s still “gas in the tank” for a rally and that investors should stick with the trades that are already working — artificial intelligence, Ozempic-related stocks, financials and industrials, bitcoin and proxies, and small-caps.

First, he notes that the S&P 500 is “soft” going into the FOMC meeting, and four out of seven times that’s been the case, stocks tend to rally afterward. That’s because a rally would need an element of relief or surprise — and the way investors have been on edge about the economy and the possibility of a soft landing, they’re likely to be put at ease by Wednesday’s meeting.

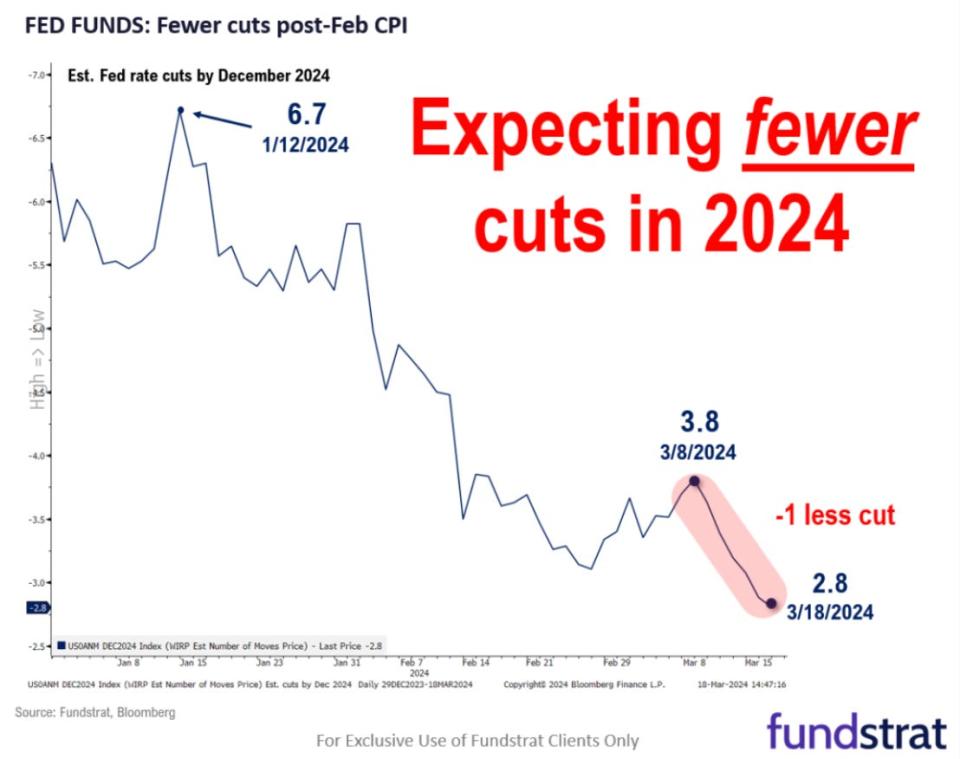

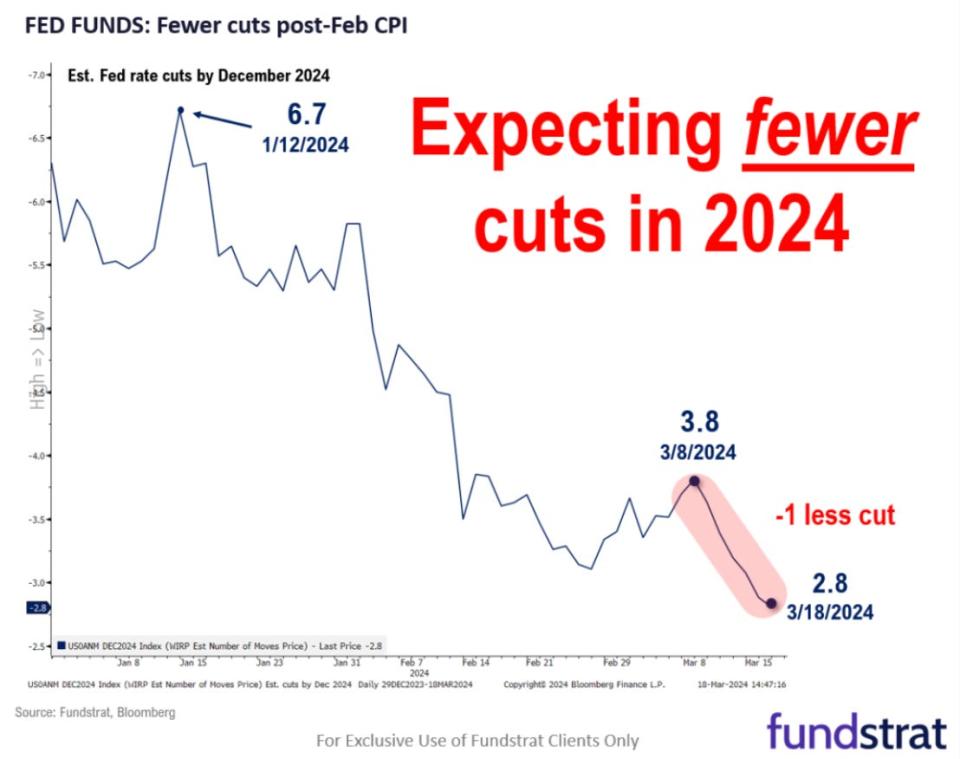

Second, investors have, for the most part, priced in the bad news, mainly the possibility of fewer rate cuts arriving later in the year than previously expected.

“Currently, the market sees about 3 cuts of 25 [basis points] each,” he wrote. “And if this is reduced to just 1 cut, it is arguably dovish. The only risk is if the Fed decides to hike rates in 2024. This is not probable.”

Third, stocks will rally because of the way interest rates have been moving. Yields on the 10-year Treasury have slid lower, signaling a short-term peak, Lee says.

Then there’s the fact Jerome Powell was already leaning dovish in his testimony to Congress a few weeks ago, Lee notes, which means he’s likely to strike a similar tone on Wednesday.

Story continues

Finally, Fundstrat’s Mark Newton said the S&P 500 could hit 5,250 to 5,300 after the March meeting. The index was trading at 5,174 Wednesday morning, implying upside of about 2.5%.

“The skepticism toward equities is still prevalent among institutional investors that we have visited with recently,” Lee wrote. “And this caution, coupled with their expectation of a ‘hawkish’ Fed, is the reason we expect stocks to rally.”

Read the original article on Business Insider