Marina113

Elevator Pitch

Renault SA (OTCPK:RNSDF) [RNO:FP] is still rated as a Buy.

My earlier write-up, published on September 11, 2023, highlighted that Renault’s “Ampere and Alpine businesses put the company in a good position to benefit from a greener and electric future.” With this update, my attention turns to RNSDF’s first quarter top-line performance, the stock’s dividend policy, and the company’s outlook.

Renault delivered a Q1 2024 revenue beat, which has favorable read-throughs for its full-year prospects. RNSDF is also confident that its business operations can generate sufficient cash flow to support an increase in the dividend payout to 30% for the intermediate term. I stay bullish on Renault with a Buy rating.

First Quarter Revenue Was Ahead Of Expectations

Last week, Renault issued a press release providing an update on its business operations for the first quarter of 2024. The company releases its complete financials on a semi-annual basis, so it only offers limited financial disclosures for Q1 and Q3.

RNSDF’s actual Q1 2024 revenue was EUR11.7 billion, which was equivalent to a +5.9% top-line expansion adjusted for foreign exchange effects. More significantly, Renault’s first quarter top line came in +1.4% better than the sell side analysts’ consensus forecast of EUR11,542 million (source: S&P Capital IQ).

There are two major drivers of Renault’s first quarter revenue beat.

One key driver is price hikes. In its Q1 2024 results presentation slides, RNSDF indicated that favorable pricing boosted its Automotive segment’s revenue by +EUR429 million YoY on a constant currency basis.

The other key driver is the good performance of the company’s Sales Financing segment. Revenue for Renault’s Sales Financing segment jumped by +30.7% YoY (adjusted for foreign exchange effects) to EUR1,246 million in the most recent quarter. At its Q1 2024 analyst call (transcript sourced from S&P Capital IQ), RNSDF explained that its Sales Financing segment’s top-line performance in Q1 2024 benefited from higher interest rates.

Spotlight On Dividend Policy And Sale Of Nissan Shares

In its FY 2023 earnings presentation, RNSDF noted that the company has a goal of raising its dividend payout ratio from the current 17.5% to 35.0% in the “mid-term.” Separately, Renault announced on March 27, 2024, that it proposed to “sell to Nissan (OTCPK:NSANY) (OTCPK:NSANF) up to 100,242,900 Nissan shares” that it owns with a potential “cash inflow of up to €362 million” for the first half of the year.

At the company’s latest Q1 2024 analyst briefing, RNSDF clarified that “the 35% payout” target will be met by “the net income that’s generated by the group” and “disconnected from Nissan.” Renault also added at the most recent quarterly analyst call that the “proceeds coming from Nissan shares” offer “upside from a cash generation” and “deleveraging perspective.”

Renault’s clarification at the recent first quarter analyst call has positive read-throughs. A favorable read-through is that RNSDF is confident that it can increase the proportion of capital returned to shareholders via dividends over time with the cash flow derived from its business operations. Another positive takeaway is that Renault is likely to deploy the sales proceeds for Nissan shares to other (apart from dividends) value-accretive capital allocation initiatives like debt repayment.

FY 2024 Guidance Is Likely To Be Met

Renault reiterated its existing fiscal 2024 guidance of a 7.5% “operating margin” and a EUR2.5 billion “free cash flow” at the minimum in its Q1 2024 business update press release.

The factors that supported RNSDF’s first quarter revenue beat are likely to remain as tailwinds for the company in the remainder of 2024. Renault indicated at the recent quarterly analyst briefing that “we will continue to have positive pricing” this year. Also, the company’s Sales Financing segment is likely to do well going forward in the current “higher for longer” interest rate environment.

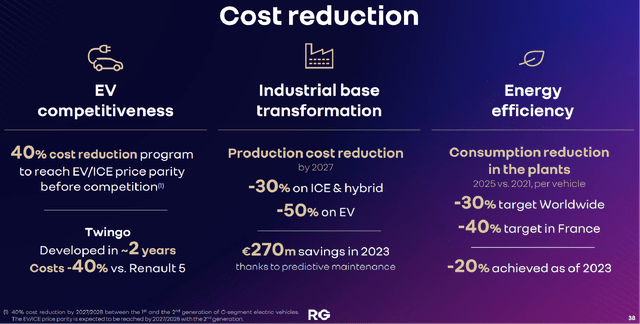

Apart from the top-line expansion drivers mentioned above, Renault has financial performance improvement levers like new vehicle launches and expense optimization for 2024 as outlined in the charts below.

RNSDF’s Planned New Vehicle Launches

Renault’s Q1 2024 Analyst Presentation Slides

Renault’s Expense Optimization Plans

Renault’s Q1 2024 Analyst Presentation Slides

In a nutshell, I am optimistic that Renault’s actual full-year FY 2024 financial results can meet or even exceed its management guidance.

Downside Risks

Readers should pay attention to certain risk factors for Renault.

Firstly, RNSDF’s Sales Financing segment might perform below expectations, if the Fed starts cutting rates in an aggressive manner.

Secondly, a failure to execute well on new vehicle launches and its expense optimization plans will affect Renault’s ability to meet its full-year guidance.

Thirdly, a longer-than-expected time taken for Renault to raise its dividend payout ratio to 35% could disappoint income-focused investors.

Concluding Thoughts

I think that Renault’s full-year FY 2024 financial performance will be as good if not better than its guidance, considering the favorable read-throughs from its first quarter top-line beat. Also, Renault trades at an undemanding low-single digit (or 3.7 times to be exact) consensus next twelve months’ normalized P/E as per S&P Capital IQ data. As such, I retain a Buy rating for Renault.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.